Innovations in Material Science

Innovations in material science are playing a pivotal role in shaping the Closed Cell Foam Market. Advances in manufacturing techniques and formulations have led to the development of high-performance closed cell foams that offer enhanced durability, thermal insulation, and moisture resistance. These innovations are particularly relevant in industries such as construction and aerospace, where material performance is critical. The introduction of eco-friendly formulations is also gaining traction, aligning with sustainability trends. As manufacturers continue to invest in research and development, the Closed Cell Foam Market is likely to benefit from a broader range of applications and improved product offerings, potentially increasing market penetration.

Rising Demand in Automotive Sector

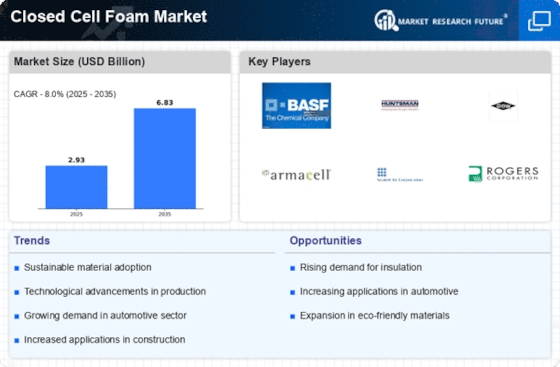

The Closed Cell Foam Market is experiencing a notable surge in demand from the automotive sector. This growth is primarily driven by the increasing need for lightweight materials that enhance fuel efficiency and reduce emissions. Closed cell foam is utilized in various automotive applications, including insulation, soundproofing, and cushioning. According to recent data, the automotive industry accounts for a substantial share of the closed cell foam market, with projections indicating a compound annual growth rate of approximately 5% over the next few years. As manufacturers strive to meet stringent environmental regulations, the adoption of closed cell foam is likely to expand, further solidifying its position within the Closed Cell Foam Market.

Expansion in Packaging Applications

The Closed Cell Foam Market is witnessing significant growth due to the expanding applications in packaging. Closed cell foam offers excellent cushioning and protection for fragile items, making it a preferred choice for various industries, including electronics, pharmaceuticals, and consumer goods. The increasing e-commerce sector has further propelled the demand for effective packaging solutions, as companies seek to ensure product safety during transit. Market data suggests that the packaging segment is projected to grow at a rate of 6% annually, highlighting the potential for closed cell foam to capture a larger market share. This trend indicates a promising future for the Closed Cell Foam Market as it adapts to the evolving needs of packaging.

Increased Focus on Energy Efficiency

The Closed Cell Foam Market is benefiting from an increased focus on energy efficiency across various sectors. Closed cell foam is recognized for its superior insulation properties, making it an ideal choice for applications in building and construction. As energy costs rise and regulations become more stringent, the demand for energy-efficient materials is likely to escalate. Recent data indicates that the construction sector is projected to grow at a rate of 5% annually, with closed cell foam playing a crucial role in achieving energy efficiency goals. This trend underscores the potential for the Closed Cell Foam Market to thrive as it aligns with broader energy conservation initiatives.

Growth in Sports and Leisure Activities

The Closed Cell Foam Market is experiencing growth driven by the rising popularity of sports and leisure activities. Closed cell foam is widely used in various sporting goods, including mats, pads, and flotation devices, due to its lightweight and buoyant properties. The increasing participation in outdoor and recreational activities is expected to boost demand for these products. Market analysis indicates that the sports and leisure segment is anticipated to grow at a rate of 4% annually, reflecting a growing consumer preference for high-quality, durable equipment. This trend suggests a favorable outlook for the Closed Cell Foam Market as it caters to the evolving needs of sports enthusiasts.