Chip Packaging Size

Market Size Snapshot

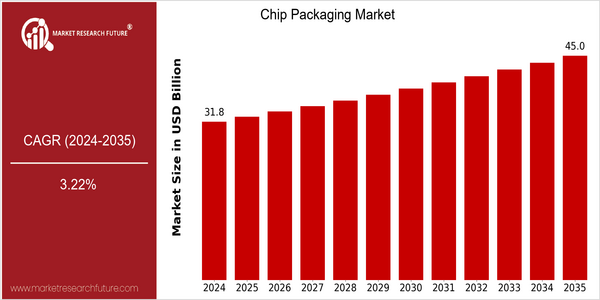

| Year | Value |

|---|---|

| 2024 | USD 31.75 Billion |

| 2035 | USD 45.0 Billion |

| CAGR (2025-2035) | 3.22 % |

Note – Market size depicts the revenue generated over the financial year

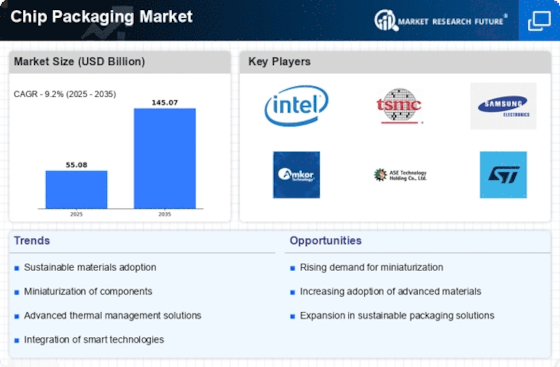

The annual rate of growth will be 3.22 per cent from 2025 to 2035. The increase in the market can be attributed to a number of factors, including the growing demand for advanced semiconductors, the increasing use of IoT devices and the growing need for miniaturization of the size of electronic components. As industry continues to develop, the demand for efficient and high-performance packaging solutions will increase further, driving further investments and developments in the industry. The major players, such as ASE, Amkor, STMicroelectronics, are actively expanding their business, establishing strategic alliances and launching new products. Recent developments, such as the development of next-generation packaging solutions, have shown that the industry is committed to innovation and the need to maintain its position in the market.

Regional Market Size

Regional Deep Dive

The chip packaging market is undergoing rapid growth in various regions, driven by the advancement of semiconductor technology and the increasing demand for miniaturization of electronic devices. The characteristics of each region are different, depending on local economic conditions, technology, and regulations. North America leads in innovation and R&D, Europe focuses on compliance and regulations, and Asia-Pacific is the manufacturing powerhouse. The Middle East and Africa are emerging markets with rising investment, and Latin America is home to a burgeoning local manufacturing and partnership industry.

Europe

- The European Union is pushing for sustainability in chip packaging, with initiatives aimed at reducing electronic waste and promoting recyclable materials, influencing manufacturers to adopt eco-friendly practices.

- Key players like ASML and Infineon Technologies are investing in advanced packaging technologies, such as 3D packaging, to enhance performance and efficiency, which is reshaping the competitive landscape.

Asia Pacific

- China continues to dominate the chip packaging market, with significant investments in local semiconductor companies and government support for technology development, which is expected to enhance its global competitiveness.

- Innovations in advanced packaging techniques, such as fan-out wafer-level packaging (FOWLP), are being driven by companies like Samsung and TSMC, catering to the growing demand for high-performance chips in consumer electronics.

Latin America

- Brazil is emerging as a key player in the chip packaging market, with local companies forming partnerships with global firms to enhance production capabilities and technology transfer.

- Government initiatives aimed at fostering technology development and attracting foreign investment are expected to stimulate growth in the semiconductor sector, including chip packaging.

North America

- The U.S. is witnessing a surge in investment in semiconductor manufacturing, with companies like Intel and TSMC planning to build new fabrication plants, which will enhance local chip packaging capabilities.

- Recent regulatory changes, such as the CHIPS Act, are incentivizing domestic production and innovation in the semiconductor supply chain, including chip packaging, which is expected to bolster the market significantly.

Middle East And Africa

- Countries like Israel are becoming hubs for semiconductor innovation, with companies such as Intel and Tower Semiconductor expanding their operations, which is expected to boost local chip packaging capabilities.

- The UAE is investing heavily in technology and innovation through initiatives like the Dubai Industrial Strategy 2030, which aims to enhance the local semiconductor ecosystem, including chip packaging.

Did You Know?

“Did you know that the global chip packaging market is expected to see a significant shift towards advanced packaging technologies, with 3D packaging solutions projected to account for a substantial portion of the market by 2025?” — Market Research Future

Segmental Market Size

The Chip Package Market is experiencing stable growth, with the increasing demand for advanced semiconductors from various industries. This growth is mainly driven by the miniaturization of electronics, which requires the development of new packaging solutions, and the 5G expansion, which requires the development of high-performance chips. Also, the energy conservation policies of the government and the trend of the digitalization of society are driving the demand for advanced packaging. Intel and TSMC are the leading companies in the advanced packaging market, and they are already in the advanced packaging stage, with 3D packaging and system-in-package (SiP) solutions. These solutions are used in the fields of automobiles, communications and consumer products. The high-density chip package is used in these three areas to improve the performance and reliability of the chip. The trend of sustainable manufacturing and the challenges of the semiconductor supply chain are also driving the innovation in this area. The advanced thermal management and fan-out wafer-level packaging (FO-WLP) are the main trends in the future development of chip packaging.

Future Outlook

During the forecast period from 2024 to 2035, the market for chip packaging will continue to grow steadily, from $31.75 billion to $45 billion, at a compound annual growth rate of 3.22%. The growth of the market is mainly driven by the increasing demand for advanced semiconductor technology in the consumer electronics, automotive and telecommunications industries. The development of the Internet of Things and the fifth generation of telecommunications will also increase the demand for high-speed and high-efficiency chip packaging solutions, which will continue to drive the market. The development of three-dimensional packaging and system-in-package solutions are expected to revolutionize the industry. It is not only in line with the industry's trend towards miniaturization and energy conservation. But also to meet the needs of the Internet of Things and the fifth generation of telecommunications. In addition, the government's policy support for the development of the industry will also be reflected in the investment in chip packaging technology, which will also promote the development of the market. By 2035, the share of advanced packaging technology will reach about 40%, which will be a major shift in the industry towards more advanced packaging solutions to meet the needs of the next generation of applications.

Leave a Comment