Regulatory Compliance Pressures

In China, regulatory compliance is becoming a critical driver for the virtualization security market. The government has implemented stringent data protection laws, such as the Personal Information Protection Law (PIPL), which mandates organizations to secure personal data effectively. Non-compliance can result in hefty fines, reaching up to 50 million yuan or 5% of annual revenue. As a result, businesses are compelled to adopt virtualization security solutions that align with these regulations. The virtualization security market is likely to benefit from this trend, as companies invest in technologies that ensure compliance while safeguarding their virtual infrastructures. This regulatory landscape creates a significant opportunity for vendors offering compliant security solutions.

Increasing Cybersecurity Threats

The virtualization security market in China is experiencing growth due to the rising frequency and sophistication of cyber threats. As organizations increasingly adopt virtualization technologies, they become more vulnerable to attacks such as data breaches and ransomware. Reports indicate that cyber incidents in China have surged by over 30% in recent years, prompting businesses to invest in robust security measures. This trend highlights the necessity for advanced security solutions tailored for virtual environments. Consequently, the demand for virtualization security solutions is expected to rise, as companies seek to protect sensitive data and maintain operational integrity. The virtualization security market is thus positioned to expand as organizations prioritize cybersecurity in their digital transformation strategies.

Rising Awareness of Data Privacy

In China, there is a growing awareness of data privacy among consumers and businesses alike, which is driving the virtualization security market. As data breaches become more prevalent, organizations are recognizing the importance of protecting sensitive information. This heightened awareness is prompting companies to invest in virtualization security solutions that ensure data integrity and confidentiality. Surveys indicate that over 60% of Chinese consumers are concerned about how their data is handled, influencing businesses to adopt stringent security measures. The virtualization security market is thus likely to expand as organizations prioritize data protection in their operational strategies.

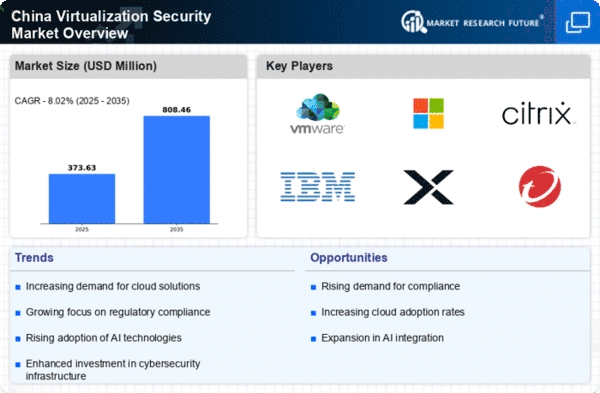

Growth of Cloud Computing Adoption

The rapid adoption of cloud computing in China is significantly influencing the virtualization security market. As organizations migrate to cloud-based environments, the need for effective security measures becomes paramount. According to recent statistics, over 70% of Chinese enterprises are expected to utilize cloud services by 2026. This shift necessitates the implementation of virtualization security solutions to protect data and applications hosted in the cloud. The virtualization security market is poised for growth as businesses seek to mitigate risks associated with cloud vulnerabilities. Consequently, vendors that provide comprehensive security solutions tailored for cloud environments are likely to see increased demand.

Technological Advancements in Security Solutions

Technological advancements are playing a pivotal role in shaping the virtualization security market in China. Innovations such as artificial intelligence (AI) and machine learning (ML) are enhancing the capabilities of security solutions, enabling organizations to detect and respond to threats more effectively. The integration of these technologies into virtualization security products is expected to drive market growth. As businesses seek to leverage cutting-edge solutions to safeguard their virtual environments, the virtualization security market is likely to witness increased investment. This trend suggests a promising future for vendors that can offer advanced security technologies tailored to the evolving needs of the market.