Rising Cybersecurity Threats

This market is experiencing heightened demand. due to the increasing frequency and sophistication of cyber threats. Organizations are recognizing the necessity of robust security measures to protect their virtual environments. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, prompting a shift towards advanced security solutions. This trend is particularly pronounced in sectors such as finance and healthcare, where sensitive data is at risk. As a result, companies are investing in virtualization security solutions to mitigate these threats, leading to a projected growth rate of 15% in the market. The urgency to safeguard virtual infrastructures is driving innovation and adoption of comprehensive security frameworks within the virtualization security market.

Increased Virtualization Adoption

This market is benefiting from the widespread adoption of virtualization technologies. across various industries. As organizations transition to virtualized environments for improved efficiency and cost savings, the need for security solutions becomes paramount. In 2025, it is projected that over 80% of enterprises will utilize virtualization in their IT infrastructure, creating a substantial market for security products tailored to these environments. This trend is particularly evident in sectors such as education and retail, where virtualization enables scalability and flexibility. Consequently, the virtualization security market is poised for growth as businesses seek to protect their virtual assets from potential vulnerabilities. The integration of security measures into virtualization strategies is becoming a standard practice, further driving market expansion.

Growing Awareness of Data Breaches

This market is witnessing growth driven by the increasing awareness of data breaches. and their repercussions. High-profile incidents have underscored the importance of securing virtual environments, prompting organizations to prioritize cybersecurity investments. In 2025, it is anticipated that the average cost of a data breach will exceed $4 million, further motivating businesses to adopt robust security measures. This heightened awareness is leading to a shift in organizational culture, where security is becoming a fundamental aspect of IT strategy. As companies recognize the potential financial and reputational damage associated with data breaches, the virtualization security market is expected to expand as organizations seek to implement proactive security solutions to safeguard their virtual assets.

Regulatory Compliance Requirements

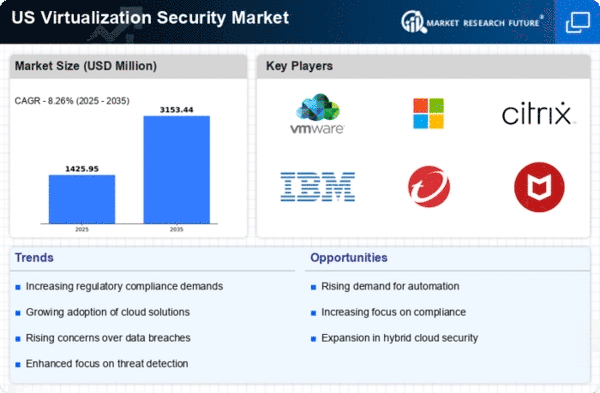

This market is significantly influenced by the evolving landscape of regulatory compliance.. Organizations are increasingly required to adhere to stringent regulations such as GDPR and HIPAA, which mandate the protection of sensitive data. In 2025, compliance-related expenditures are expected to reach $20 billion in the US alone, highlighting the financial implications of non-compliance. This regulatory pressure compels businesses to invest in virtualization security solutions that ensure data integrity and confidentiality. As companies strive to meet these compliance standards, the demand for specialized security tools and services is likely to surge, contributing to the overall growth of the virtualization security market. The intersection of compliance and security is becoming a critical focus for organizations aiming to avoid hefty fines and reputational damage.

Emergence of Hybrid IT Environments

This market is increasingly shaped by the emergence of hybrid IT environments., where organizations blend on-premises and cloud-based resources. This complexity introduces unique security challenges, necessitating advanced solutions to protect data across diverse platforms. In 2025, it is estimated that 70% of enterprises will adopt hybrid IT strategies, amplifying the demand for comprehensive security frameworks. Organizations must ensure that their virtualization security measures are capable of addressing vulnerabilities that arise from this hybrid approach. As businesses navigate the intricacies of managing security in hybrid environments, the virtualization security market is likely to see a surge in demand for integrated security solutions that provide visibility and control across all platforms.