Emergence of New Regulatory Frameworks

The evolving regulatory landscape in China presents both challenges and opportunities for the telecom service-assurance market. New regulations aimed at enhancing consumer protection and service quality are being introduced, compelling telecom operators to adopt more stringent service-assurance practices. Compliance with these regulations is crucial for maintaining operational licenses and avoiding penalties. The introduction of quality-of-service standards mandates that operators implement robust monitoring and reporting systems. This regulatory pressure drives the demand for advanced service-assurance solutions that can ensure compliance while optimizing network performance. As the regulatory environment continues to evolve, the telecom service-assurance market is likely to experience growth driven by the need for compliance and quality assurance.

Rising Demand for High-Speed Connectivity

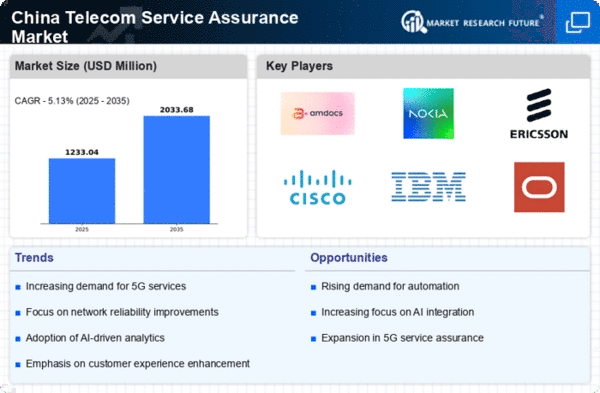

The increasing demand for high-speed connectivity in China is a primary driver for the telecom service-assurance market. As consumers and businesses alike seek faster internet speeds, telecom operators are compelled to enhance their service quality. This demand is reflected in the growing number of 5G subscriptions, which reached approximately 500 million in 2025. Consequently, telecom service-assurance solutions are essential for ensuring optimal network performance and reliability. The need for seamless connectivity across various applications, including IoT and smart cities, further emphasizes the importance of robust service-assurance mechanisms. As competition intensifies among telecom providers, the ability to deliver superior service quality becomes a critical differentiator, thereby propelling the growth of the telecom service-assurance market in China.

Growing Focus on Data Privacy and Security

In an era where data breaches and cyber threats are increasingly prevalent, the focus on data privacy and security is a significant driver for the telecom service-assurance market in China. Telecom operators are under pressure to protect customer data and ensure secure communications. This necessity has led to the implementation of advanced security measures and protocols within service-assurance frameworks. The market for cybersecurity solutions in the telecom sector is projected to grow by 15% annually, indicating a strong demand for integrated service-assurance solutions that encompass security features. As customers become more aware of data privacy issues, telecom providers must prioritize security in their service offerings, thereby enhancing the relevance of service-assurance solutions.

Increased Investment in Network Infrastructure

China's substantial investments in network infrastructure significantly influence the telecom service-assurance market. The government has allocated billions of dollars to enhance telecommunications infrastructure, particularly in rural and underserved areas. This investment aims to bridge the digital divide and ensure equitable access to high-quality services. As new technologies are deployed, such as fiber optics and 5G networks, the complexity of managing these networks increases. Consequently, telecom service-assurance solutions become vital for monitoring and optimizing network performance. The anticipated growth in network infrastructure spending, projected to reach $200 billion by 2026, underscores the necessity for effective service-assurance strategies to maintain service quality and customer satisfaction.

Adoption of Advanced Analytics and AI Technologies

The integration of advanced analytics and artificial intelligence (AI) technologies into the telecom service-assurance market is transforming how operators manage network performance. These technologies enable real-time data analysis, predictive maintenance, and automated troubleshooting, which enhance operational efficiency. As telecom operators in China increasingly adopt AI-driven solutions, the demand for sophisticated service-assurance tools rises. The market for AI in telecommunications is expected to reach $10 billion by 2027, reflecting the growing reliance on data-driven decision-making. By leveraging AI and analytics, telecom providers can proactively address service issues, improve customer satisfaction, and optimize resource allocation, thereby driving growth in the telecom service-assurance market.