Adoption of 5G Technology

The rollout of 5G technology in Germany is a pivotal driver for the telecom service-assurance market. With its promise of ultra-fast data speeds and low latency, 5G is transforming how services are delivered. As of November 2025, approximately 40% of German mobile users have access to 5G networks, which necessitates sophisticated service-assurance solutions to manage the complexities associated with this new technology. The telecom service-assurance market must adapt. This is to ensure that service quality meets the heightened expectations of users. This transition presents both challenges and opportunities for service providers, as they must implement advanced monitoring systems to maintain service integrity and performance.

Emergence of IoT Applications

The proliferation of Internet of Things (IoT) applications in Germany is reshaping the landscape of the telecom service-assurance market. As more devices become interconnected, the demand for reliable service assurance becomes paramount. IoT applications require consistent connectivity and performance, which places additional pressure on telecom operators to ensure service quality. Currently, it is estimated that over 30 million IoT devices are operational in Germany, and this number is expected to grow significantly. The telecom service-assurance market must evolve to address the unique challenges posed by IoT, including the need for real-time monitoring and management of diverse device types, thereby driving innovation and investment in assurance solutions.

Growing Focus on Data Analytics

The integration of data analytics into service-assurance processes is becoming increasingly vital in the telecom sector in Germany. As operators collect vast amounts of data, the ability to analyze this information effectively can lead to improved service quality and customer satisfaction. The telecom service-assurance market is witnessing a shift towards analytics-driven solutions, with 55% of service providers indicating that data analytics plays a crucial role in their assurance strategies. This trend indicates a growing recognition of the importance of data in optimizing network performance and enhancing customer experiences, thereby driving further investment in advanced analytics tools.

Rising Demand for Network Reliability

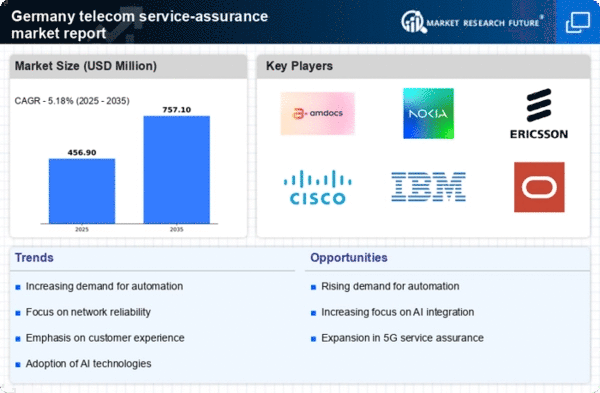

The increasing reliance on digital communication in Germany drives the demand for enhanced network reliability within the telecom service-assurance market. As businesses and consumers alike depend on uninterrupted connectivity, service providers are compelled to invest in robust assurance solutions. Recent data indicates that 75% of German enterprises prioritize network reliability, leading to a surge in demand for service-assurance technologies. This trend is likely to continue as the digital economy expands, necessitating advanced monitoring and management tools to ensure optimal performance. Consequently, The telecom service-assurance market is expected to experience significant growth. Providers seek to meet these reliability expectations and maintain competitive advantages.

Increased Regulatory Compliance Requirements

In Germany, the telecom sector faces stringent regulatory compliance requirements that significantly impact the telecom service-assurance market. Regulatory bodies are increasingly mandating service quality standards, which compel telecom operators to enhance their service-assurance capabilities. Compliance with these regulations is not merely a legal obligation; it is also a competitive differentiator. As of November 2025, 60% of telecom operators report that regulatory compliance has driven their investment in service-assurance technologies. This trend suggests that the telecom service-assurance market will continue to expand as operators seek to align with regulatory expectations while ensuring high-quality service delivery.