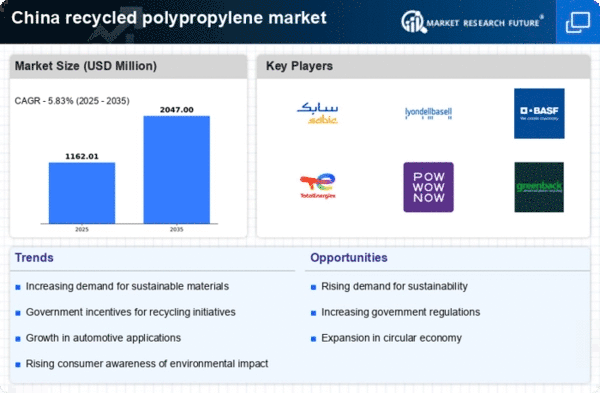

Top Industry Leaders in the China Recycled Polypropylene Market

The China recycled polypropylene (rPP) market is booming, driven by environmental consciousness, circular economy initiatives, and surging demand for sustainable materials. This dynamic landscape is teeming with players vying for market dominance, each wielding diverse strategies to secure their share.

Competitive Strategies:

- Product Quality & Innovation: Companies like Sinopec and ExxonMobil invest heavily in advanced recycling technologies to produce high-purity rPP with properties akin to virgin materials. This opens doors to diverse applications beyond basic packaging, like automotive components and consumer goods.

- Pricing Strategies: Cost leadership plays a crucial role with companies like Zhejiang Huaxiang Plastic offering rPP as an economical alternative. Alternatively, premium pricing strategies focused on superior quality and certifications are adopted by companies like Shanghai Xinde New Material Technology.

- Effective Marketing: Engaging digital campaigns, participation in sustainability forums, and collaborations with industry associations like the China Plastics Processing Industry Association build brand visibility and credibility for companies like Jiangsu Yurun New Material Technology.

Factors Influencing Market Share:

- Recycling Infrastructure: Companies with established waste collection and processing networks, like CNBM Waste Resources, have a stronger supply chain advantage. Investments in sorting and cleaning technologies further enhance efficiency and quality.

- Government Regulations: Stringent environmental policies and waste management regulations, like the "Plastic Pollution Control Action Plan," incentivize rPP usage, favoring companies who demonstrate compliance and circular economy alignment.

- Partnerships & Collaborations: Building strong partnerships across the entire value chain, from waste collectors to brand owners, creates a competitive edge for companies like Guangdong Nan Ya Plastics. Co-developing innovative rPP solutions further strengthens market position.

List of Key Players in the China Recycled Polypropylene Market

-

MBA Polymers Inc. (Austria)

-

Veolia Polymers NL B.V. (The Netherlands)

-

SUEZ (France)

-

KW Plastics (US)

-

Jayplas (UK)

-

B&B Plastics Inc. (US)

-

Custom Polymers (US)

-

Joe's Plastic, Inc. (US)

-

Ultra Poly Corporation (US)

-

PLASgran Ltd. (UK)

Recent Developments:

August 2023: Sinopec unveils a new rPP plant in Shanghai, boosting their production capacity by 50,000 tons annually. This move caters to the growing demand for high-quality rPP in automotive applications.

September 2023: The Chinese government announces increased financial support for recycling infrastructure development, allocating $1 billion to promote advanced sorting and processing technologies. This is expected to further streamline the rPP supply chain.

October 2023: ExxonMobil partners with Jiangsu Yurun to launch a pilot project exploring chemical recycling of mixed plastic waste. This technology promises to unlock new sources of rPP feedstock and potentially expand market reach.

November 2023: The China National Textile and Apparel Council issues new guidelines for sustainable fashion, mandating a minimum use of 30% recycled content in all textile products by 2025. This regulation is expected to significantly boost rPP demand in the textile industry.

December 2023: A consortium of leading rPP producers, including Zhejiang Huaxiang Plastic and Shanghai Xinde, establishes the "China Recycled Polypropylene Alliance." This collaborative effort aims to standardize quality control, promote technology advancement, and enhance market transparency.