China Recycled Polypropylene Size

China Recycled Polypropylene Market Growth Projections and Opportunities

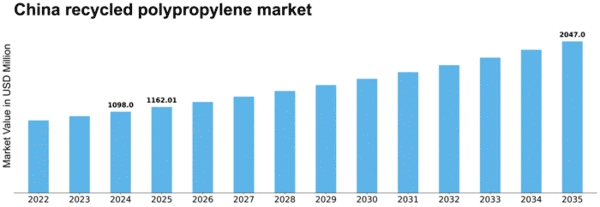

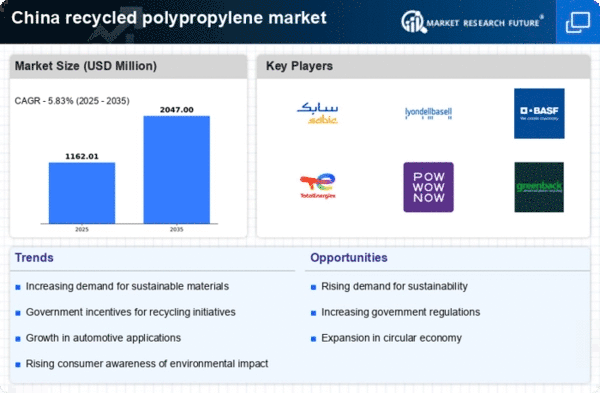

The China Recycled Polypropylene (PP) Market is shaped by many factors. Rising awareness and emphasis on economic and informal economy practices in China drives this sector. Every 2022, China's recycled polypropylene market was worth USD 8.5 billion. The recycled polypropylene business is expected to grow from USD 9.06 Billion in 2023 to USD 15.108 Billion in 2032, a CAGR of 6.60%.

China's recycled polypropylene market is shaped by administrative changes. The Chinese government has implemented policies to encourage firms to reuse and use recycled materials. The recycled polypropylene business thrives under strict environmental and waste management regulations. Compliance with these rules is driving companies to use recycled polypropylene in their manufacturing.

Reusing process mechanical advances drive market aspects. Continuous innovation improves polypropylene recycling efficiency and quality. High-level organizing, cleaning, and handling technologies enable the production of recycled polypropylene suitable for many applications. Creative recycling methods make recycled polypropylene stronger than pure polypropylene.

Rising need for affordable bundling also affects market factors. China is increasingly interested in eco-friendly and recycled packaging materials, and the packaging industry is a major polypropylene buyer. As shoppers become more environmentally concerned, they prefer products with practical packaging, pushing demand for recycled polypropylene in packaging.

China's recycled polypropylene market is affected by economic conditions and pricing. Companies seeking to balance environmental responsibility with commercial viability should consider recycled polypropylene's cost. Recycled polypropylene should gain popularity as its cost decreases and businesses see its value.

Competitive rivalry and industrial coordination shape market elements. Recycled polypropylene manufacturers, waste management agencies, and end-users collaborate to improve recycling methods, recycled materials, and their use. Organizations and collaborations enhance China's recycled polypropylene sector. Consumer preferences and company supportability goals affect market factors.

Global trends like the plastic waste crisis and the circular economy affect the China Recycled Polypropylene Market. Recycled polypropylene can benefit from global attention to plastic pollution and a circular economy. Dynamic Chinese cooperation in global supportability efforts strengthens the recycled polypropylene market.

Leave a Comment