Growing Aging Population

The increasing aging population in China is a pivotal driver for the neurology devices market. As the demographic shifts, the prevalence of neurological disorders such as Alzheimer's and Parkinson's disease is expected to rise. Reports indicate that by 2030, approximately 25% of the population will be over 60 years old, leading to a heightened demand for effective diagnostic and therapeutic devices. This demographic trend necessitates advancements in neurology devices, as healthcare systems strive to accommodate the needs of older adults. The market is projected to expand significantly, with estimates suggesting a growth rate of around 10% annually. Consequently, manufacturers are likely to focus on developing innovative solutions tailored to this demographic, thereby enhancing the overall landscape of the neurology devices market.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in China are significantly influencing the neurology devices market. The Chinese government has been actively investing in healthcare reforms, which include increasing funding for neurological research and device development. In recent years, the government allocated over $1 billion to support innovation in medical technologies, particularly in neurology. This funding is expected to facilitate collaborations between public institutions and private companies, fostering the development of advanced neurology devices. Furthermore, regulatory frameworks are being streamlined to expedite the approval process for new devices, which could potentially enhance market entry for innovative products. As a result, the neurology devices market is likely to experience accelerated growth driven by these supportive government policies.

Technological Integration in Healthcare

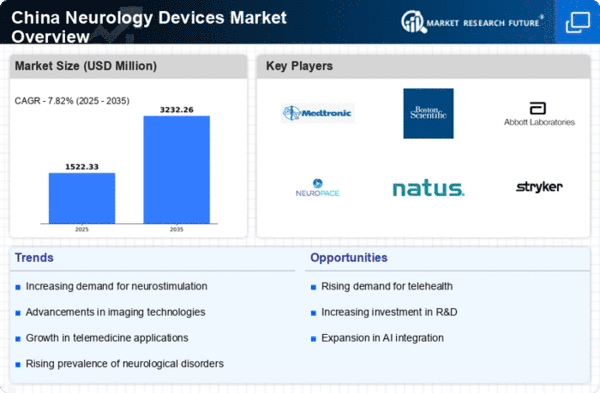

The integration of advanced technologies such as artificial intelligence (AI) and telemedicine into healthcare is reshaping the neurology devices market in China. These technologies are enhancing the capabilities of neurology devices, allowing for more accurate diagnostics and personalized treatment plans. For instance, AI algorithms are being utilized to analyze neurological data, leading to improved patient outcomes. Additionally, telemedicine platforms are facilitating remote monitoring and consultations, which are particularly beneficial for patients with chronic neurological conditions. The market is witnessing a surge in the adoption of these technologies, with projections indicating a growth rate of 12% in the next five years. This technological integration is likely to create new opportunities for innovation within the neurology devices market, as companies strive to develop devices that leverage these advancements.

Rising Awareness of Neurological Disorders

There is a growing awareness of neurological disorders among the Chinese population, which is driving demand for neurology devices. Educational campaigns and increased media coverage have contributed to a better understanding of conditions such as epilepsy, stroke, and multiple sclerosis. This heightened awareness is leading to earlier diagnosis and treatment, which in turn is boosting the demand for advanced neurology devices. Market data suggests that the awareness initiatives have resulted in a 15% increase in consultations for neurological issues over the past two years. As patients become more informed about their conditions, they are more likely to seek out innovative devices that can improve their quality of life. Consequently, this trend is expected to positively impact the neurology devices market, as manufacturers respond to the increasing demand for effective solutions.

Increasing Incidence of Lifestyle-Related Neurological Disorders

The rising incidence of lifestyle-related neurological disorders in China is emerging as a crucial driver for the neurology devices market. Factors such as urbanization, sedentary lifestyles, and dietary changes have contributed to an increase in conditions like stroke and migraines. Recent studies indicate that the prevalence of stroke has risen by 20% over the last decade, prompting a greater need for effective monitoring and treatment devices. As healthcare providers seek to address these challenges, there is a growing demand for neurology devices that can assist in the management and prevention of these disorders. This trend is likely to propel the market forward, as manufacturers focus on creating innovative solutions that cater to the specific needs of patients suffering from lifestyle-related neurological issues.