Rising Environmental Regulations

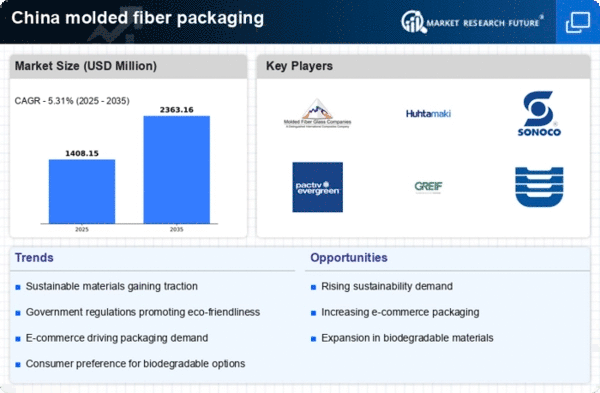

The molded fiber-packaging market in China is experiencing a surge in demand due to increasing environmental regulations. The Chinese government has implemented stringent policies aimed at reducing plastic waste and promoting sustainable packaging solutions. As a result, manufacturers are compelled to adopt eco-friendly materials, leading to a significant shift towards molded fiber packaging. This market segment is projected to grow at a CAGR of approximately 8% over the next five years, driven by the need for compliance with these regulations. Companies that invest in molded fiber solutions are likely to gain a competitive edge, as consumers increasingly favor brands that demonstrate environmental responsibility. The molded fiber-packaging market is thus positioned to benefit from these regulatory changes, fostering innovation and investment in sustainable practices.

Growth of the Food Delivery Sector

The molded fiber-packaging market in China is benefiting from the rapid expansion of the food delivery sector. With the increasing popularity of online food ordering, there is a rising demand for packaging that is both functional and sustainable. Molded fiber packaging offers an ideal solution, as it is lightweight, durable, and environmentally friendly. The food delivery market in China is projected to reach a value of $100 billion by 2026, creating a substantial opportunity for molded fiber-packaging manufacturers. As restaurants and food service providers seek to enhance their sustainability profiles, the molded fiber-packaging market is poised for growth, driven by the need for innovative and eco-conscious packaging solutions.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are playing a crucial role in the molded fiber-packaging market in China. Innovations such as automated production lines and improved molding techniques are enhancing efficiency and reducing costs. These advancements enable manufacturers to produce high-quality molded fiber products at a lower price point, making them more accessible to a broader range of businesses. As production capabilities improve, the molded fiber-packaging market is likely to expand, attracting new entrants and fostering competition. Furthermore, the integration of smart technologies in production processes may lead to increased customization options, allowing companies to meet specific customer needs more effectively.

Expansion of Retail and E-commerce Channels

The expansion of retail and e-commerce channels in China is significantly influencing the molded fiber-packaging market. As online shopping continues to grow, there is an increasing need for packaging that can withstand shipping and handling while also being environmentally friendly. Molded fiber packaging provides a robust solution that meets these requirements. The e-commerce sector in China is expected to surpass $2 trillion by 2025, creating a substantial demand for sustainable packaging options. This growth presents a lucrative opportunity for the molded fiber-packaging market, as businesses seek to enhance their packaging strategies to cater to the evolving preferences of consumers.

Consumer Preference for Eco-Friendly Products

In recent years, there has been a notable shift in consumer preferences towards eco-friendly products in China. This trend is significantly impacting the molded fiber-packaging market, as consumers are increasingly aware of the environmental implications of their purchasing decisions. Research indicates that approximately 70% of Chinese consumers are willing to pay a premium for sustainable packaging options. This growing demand for environmentally responsible products is prompting manufacturers to invest in molded fiber solutions, which are biodegradable and recyclable. The molded fiber-packaging market is thus likely to see substantial growth as brands align their packaging strategies with consumer expectations. This alignment not only enhances brand loyalty but also opens new avenues for market expansion.