Government Initiatives and Investments

Government initiatives in China are playing a pivotal role in the growth of the mobile mapping market. The Chinese government has been investing heavily in smart city projects, which necessitate advanced mapping solutions for effective urban management. In 2025, it is estimated that government funding for geographic information systems (GIS) and mobile mapping technologies could reach upwards of $2 billion. These investments are aimed at improving infrastructure, enhancing public services, and promoting sustainable urban development. Additionally, regulatory frameworks are being established to support the integration of mobile mapping technologies in various sectors, including transportation and public safety. This proactive approach by the government is likely to create a conducive environment for the mobile mapping market, fostering innovation and attracting private sector investments.

Urbanization and Infrastructure Development

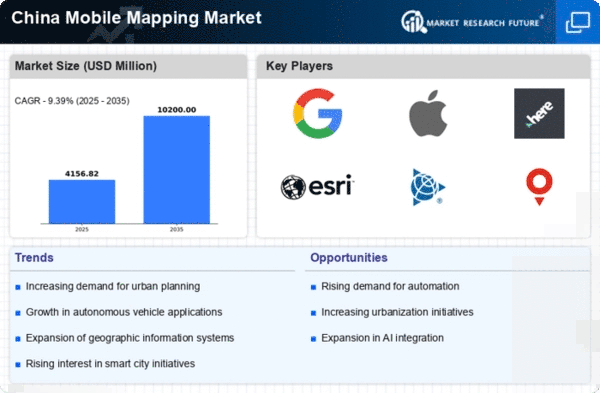

China's rapid urbanization is a key driver of the mobile mapping market. With over 60% of the population now residing in urban areas, the demand for efficient infrastructure development is at an all-time high. The mobile mapping market is essential for urban planners and developers, providing the necessary data to design and implement infrastructure projects effectively. In 2025, the market is projected to grow by approximately 10% as cities continue to expand and evolve. The need for accurate mapping solutions is critical for managing urban growth, ensuring sustainable development, and addressing challenges such as traffic congestion and environmental impact. As urban areas become more complex, the role of mobile mapping technologies in facilitating effective planning and management is likely to become increasingly prominent.

Technological Advancements in Mobile Mapping

The mobile mapping market in China is experiencing a surge due to rapid technological advancements. Innovations in sensor technology, such as LiDAR and high-resolution cameras, are enhancing the accuracy and efficiency of mapping solutions. The integration of these technologies allows for the collection of vast amounts of spatial data, which is crucial for various applications, including urban planning and infrastructure development. In 2025, the market is projected to grow by approximately 15%, driven by the increasing demand for precise mapping solutions. Furthermore, the rise of autonomous vehicles is likely to further propel the mobile mapping market, as these vehicles require accurate mapping data for navigation and safety. As a result, the mobile mapping market is becoming increasingly vital for various sectors, including transportation, construction, and environmental monitoring.

Rising Demand for Geographic Information Systems

The increasing demand for Geographic Information Systems (GIS) in China is significantly impacting the mobile mapping market. As industries such as real estate, agriculture, and environmental management seek to leverage spatial data for decision-making, the need for accurate and timely mapping solutions is becoming more pronounced. In 2025, the mobile mapping market is expected to witness a growth rate of around 12%, driven by the expanding applications of GIS across various sectors. Companies are increasingly adopting mobile mapping technologies to enhance their operational efficiency and improve service delivery. This trend indicates a shift towards data-driven decision-making, where organizations rely on precise mapping data to optimize their processes and strategies. Consequently, the mobile mapping market is positioned to benefit from this growing reliance on GIS technologies.

Integration of Mobile Mapping in Various Industries

The integration of mobile mapping technologies across diverse industries in China is driving market growth. Sectors such as transportation, construction, and agriculture are increasingly adopting mobile mapping solutions to enhance their operational capabilities. For instance, logistics companies utilize mobile mapping for route optimization, while construction firms rely on accurate mapping data for project planning and execution. In 2025, it is anticipated that the mobile mapping market will expand by around 14%, fueled by the growing recognition of the value of spatial data in improving efficiency and reducing costs. This trend suggests that as more industries recognize the benefits of mobile mapping, the market will continue to evolve, leading to innovative applications and solutions tailored to specific industry needs.