Growing Urbanization

The rapid urbanization in China is driving the demand for metal cans in various sectors. As more people move to urban areas, the consumption of packaged goods, including beverages and food, is increasing. This trend is reflected in the metal cans market, where urban consumers prefer convenient and portable packaging solutions. The urban population in China is projected to reach approximately 1 billion by 2030, which could lead to a significant rise in the demand for metal cans. Furthermore, the metal cans market benefits from the increasing number of retail outlets and supermarkets in urban areas, facilitating easier access to canned products. This urban shift not only enhances the visibility of metal cans but also encourages manufacturers to innovate and diversify their offerings to meet the evolving preferences of urban consumers.

Rising Disposable Income

The increase in disposable income among Chinese consumers is positively impacting the metal cans market. As consumers have more disposable income, they tend to spend more on premium products, including beverages and packaged foods. This trend is particularly evident in urban areas, where the middle class is expanding rapidly. The metal cans market is benefiting from this shift, as consumers are willing to pay a premium for quality products packaged in metal cans. Market analysis indicates that the demand for canned beverages is expected to rise, with a projected growth rate of 6% annually. This increase in disposable income not only boosts the sales of metal cans but also encourages manufacturers to innovate and introduce new products to cater to the evolving preferences of consumers.

Environmental Regulations

The implementation of stringent environmental regulations in China is shaping the metal cans market. The government is actively promoting recycling and sustainable practices, which aligns well with the characteristics of metal cans. Metal cans are 100% recyclable, and their production process generates less waste compared to other packaging materials. This regulatory environment encourages manufacturers to adopt eco-friendly practices, thereby enhancing the appeal of metal cans among environmentally conscious consumers. Market data suggests that the recycling rate for metal cans in China is around 70%, which is significantly higher than that of plastic packaging. As consumers increasingly prioritize sustainability, the metal cans market is likely to experience growth, driven by the demand for recyclable and environmentally friendly packaging solutions.

Health and Safety Regulations

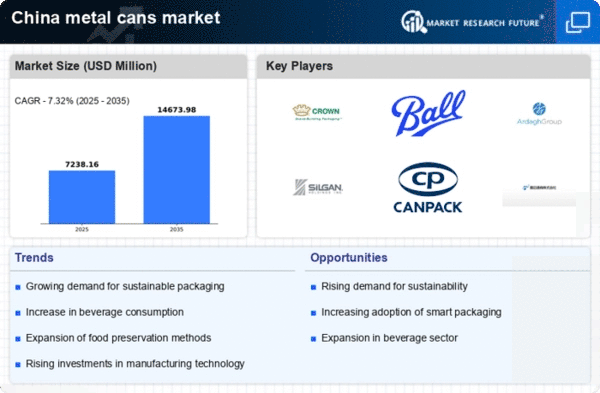

In China, stringent health and safety regulations are influencing the metal cans market. The government has implemented various standards to ensure food safety and quality, which has led to an increased preference for metal cans over other packaging materials. Metal cans are perceived as safer and more hygienic, particularly for food and beverage products. The market data indicates that the metal cans market is expected to grow at a CAGR of around 5% over the next few years, driven by these regulatory frameworks. Manufacturers are increasingly investing in compliance with these regulations, which not only enhances consumer trust but also boosts the overall market growth. As consumers become more health-conscious, the demand for safe and reliable packaging solutions like metal cans is likely to rise, further solidifying their position in the market.

Technological Innovations in Production

Technological advancements in the production processes of metal cans are significantly influencing the market in China. Innovations such as automated manufacturing and improved coating technologies are enhancing the efficiency and quality of metal can production. These advancements allow manufacturers to reduce costs and improve the durability of metal cans, making them more appealing to consumers. The metal cans market is witnessing a shift towards smart manufacturing, where data analytics and IoT technologies are being integrated into production lines. This not only streamlines operations but also enables manufacturers to respond quickly to market demands. As a result, the metal cans market is expected to grow, driven by the increased efficiency and reduced environmental impact of modern production techniques.