Expansion of E-Learning Platforms

The proliferation of e-learning platforms in China has created a substantial opportunity for the language translation-software market. As educational institutions and businesses increasingly adopt online learning solutions, the need for translation services to cater to diverse student populations becomes critical. Language translation-software can facilitate the localization of educational content, making it accessible to non-native speakers. In 2025, the e-learning sector is anticipated to grow by 25%, which may drive a corresponding increase in the demand for translation software, as educators seek to provide inclusive learning environments.

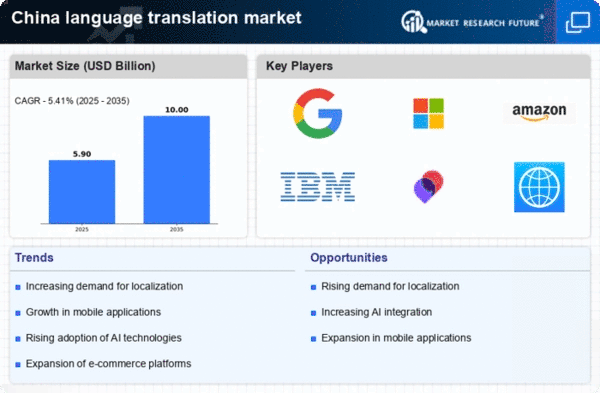

Rising Demand for Multilingual Communication

The increasing globalization of businesses in China has led to a heightened demand for effective multilingual communication. As companies expand their reach into international markets, the need for language translation-software becomes paramount. This trend is particularly evident in sectors such as e-commerce and tourism, where accurate translations can significantly enhance customer engagement. In 2025, the language translation-software market in China is projected to grow by approximately 15%, driven by the necessity for businesses to communicate seamlessly with diverse audiences. Furthermore, the rise of remote work has necessitated tools that facilitate communication across language barriers, further propelling the demand for translation solutions.

Emergence of Advanced Machine Learning Algorithms

The advent of advanced machine learning algorithms is transforming the landscape of the language translation-software market. These technologies enhance the accuracy and efficiency of translations, making them more reliable for users. In China, where linguistic nuances can significantly impact communication, the integration of sophisticated algorithms is particularly beneficial. As businesses and individuals seek high-quality translations, the market is likely to experience a surge in demand for software that leverages these advancements. By 2025, the adoption of machine learning in translation tools could lead to a market growth of approximately 22%, reflecting the increasing reliance on technology for effective communication.

Increased Internet Penetration and Digital Literacy

As internet penetration in China continues to rise, so does the accessibility of language translation-software. With over 900 million internet users, the demand for digital tools that facilitate communication in multiple languages is surging. This trend is particularly pronounced among younger demographics, who are more inclined to utilize technology for learning and communication. The language translation-software market is expected to benefit from this increase in digital literacy, with projections indicating a growth rate of 18% in 2025. Enhanced access to translation tools is likely to empower users, enabling them to engage with global content more effectively.

Government Initiatives Supporting Language Technology

The Chinese government has recognized the importance of language technology in fostering economic growth and cultural exchange. Initiatives aimed at promoting the development of language translation-software are being implemented, which may include funding for research and development, as well as partnerships with tech companies. These efforts are likely to enhance the capabilities of translation software, making it more accessible to businesses and individuals alike. In 2025, government support could potentially lead to a 20% increase in the adoption of language translation-software across various sectors, thereby solidifying its role in the digital economy.