Increased Mobile Device Usage

The proliferation of mobile devices is reshaping the landscape of the language translation-software market. With more individuals relying on smartphones and tablets for communication, the demand for mobile-friendly translation applications is on the rise. In the US, it is estimated that over 70% of internet users access content via mobile devices, prompting software developers to optimize their solutions for mobile platforms. This shift is likely to drive market growth, as users seek convenient and accessible translation tools. The language translation-software market is thus adapting to meet the needs of a mobile-centric audience, ensuring that users can communicate effectively regardless of their location.

Rising Globalization of Businesses

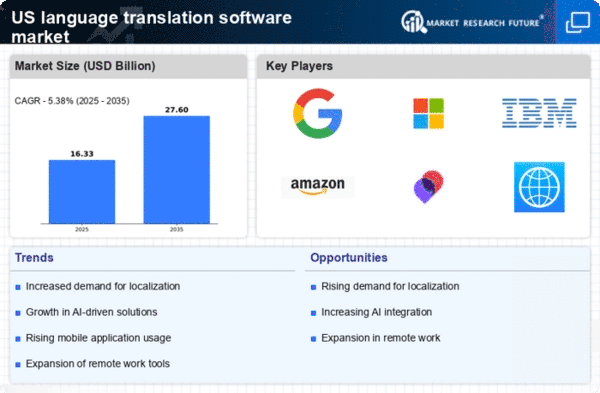

The language translation-software market is experiencing a notable surge due to the increasing globalization of businesses. As companies expand their operations internationally, the need for effective communication across diverse languages becomes paramount. This trend is particularly evident in the US, where businesses are seeking to penetrate foreign markets. According to recent data, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth is driven by the necessity for accurate translations in marketing materials, legal documents, and customer support. Consequently, the language translation-software market is becoming an essential tool for organizations aiming to enhance their global presence and ensure seamless interactions with clients and partners worldwide.

Growing Demand for Multilingual Content

The increasing demand for multilingual content is a significant driver of the language translation-software market. As businesses strive to cater to diverse customer bases, the need for high-quality translations in marketing, e-commerce, and customer service is becoming more pronounced. In the US, companies are recognizing that providing content in multiple languages can enhance customer engagement and satisfaction. This trend is reflected in the market's projected growth, with estimates suggesting a rise of approximately 15% in the next few years. Consequently, the language translation-software market is positioned to play a crucial role in helping businesses create and manage multilingual content effectively.

Regulatory Compliance and Legal Requirements

Regulatory compliance and legal requirements are increasingly influencing the language translation-software market. In the US, businesses are often mandated to provide translated materials to comply with various laws and regulations, particularly in sectors such as healthcare and finance. This necessity drives organizations to invest in reliable translation software to ensure that they meet legal obligations while effectively communicating with non-English speaking clients. The market is expected to see a growth rate of around 10% as companies prioritize compliance and seek to mitigate risks associated with miscommunication. Thus, the language translation-software market is becoming an indispensable resource for organizations navigating complex regulatory landscapes.

Technological Advancements in Software Solutions

Technological advancements are significantly influencing the language translation-software market. Innovations in natural language processing (NLP) and machine learning algorithms are enhancing the accuracy and efficiency of translation tools. In the US, software developers are increasingly integrating these technologies to provide users with more reliable and contextually relevant translations. The market is expected to reach a valuation of $5 billion by 2026, reflecting a growing reliance on sophisticated software solutions. These advancements not only improve the user experience but also enable businesses to handle large volumes of content swiftly, thereby streamlining operations and reducing costs associated with translation services.