Regulatory Support for Innovation

The regulatory environment in China appears to be increasingly supportive of innovation within the insuretech market. The China Banking and Insurance Regulatory Commission (CBIRC) has introduced various initiatives aimed at fostering technological advancements in the insurance sector. This includes sandbox programs that allow startups to test their products in a controlled environment. As a result, the insuretech market is likely to see a surge in new entrants and innovative solutions. In 2023, the market was valued at approximately $10 billion, and with favorable regulations, it could potentially grow at a CAGR of 20% over the next five years. This regulatory backing is crucial for the development of new technologies and services that cater to the evolving needs of consumers.

Integration of Advanced Technologies

The integration of advanced technologies such as blockchain and IoT is transforming the landscape of the insuretech market in China. These technologies enhance transparency, efficiency, and security in insurance transactions. For instance, blockchain can streamline claims processing and reduce fraud, while IoT devices can provide real-time data for risk assessment. As of 2025, it is projected that the adoption of these technologies could lead to a reduction in operational costs by up to 15% for insurers. This technological evolution not only improves operational efficiency but also enhances the overall customer experience. Consequently, the insuretech market is likely to witness significant growth as companies leverage these technologies to create innovative solutions.

Increased Investment in Insuretech Startups

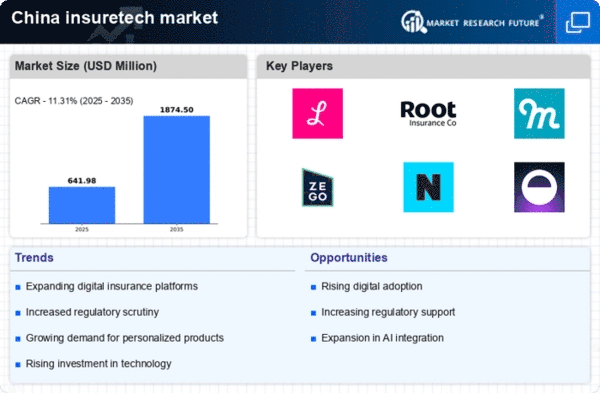

Investment in insuretech startups in China has been on the rise, indicating a robust interest in the insuretech market. Venture capital firms and private equity investors are increasingly funding innovative startups that offer disruptive solutions in the insurance sector. In 2024, investments in the insuretech sector reached approximately $3 billion, reflecting a growing confidence in the potential of these companies to reshape the industry. This influx of capital is expected to drive innovation and accelerate the development of new products and services. As a result, the insuretech market is likely to expand rapidly, with new players entering the field and established companies enhancing their technological capabilities.

Growing Awareness of Digital Insurance Solutions

There is a growing awareness among consumers in China regarding the benefits of digital insurance solutions within the insuretech market. As more individuals become familiar with online platforms and mobile applications, the demand for digital insurance products is increasing. This trend is supported by the widespread use of smartphones and the internet, which facilitate easy access to insurance services. By 2025, it is anticipated that digital insurance solutions could represent over 50% of the total market. This shift towards digitalization is prompting traditional insurers to adapt their business models and invest in technology, thereby enhancing their competitiveness in the insuretech market.

Rising Demand for Personalized Insurance Products

There is a noticeable shift in consumer preferences towards personalized insurance products in the insuretech market. As consumers become more aware of their specific needs, they are seeking tailored solutions that address their unique circumstances. This trend is driven by advancements in data analytics and artificial intelligence, which enable insurers to offer customized policies. In 2025, it is estimated that personalized insurance products could account for over 30% of the total market share. This demand for personalization is pushing companies to innovate and adapt their offerings, thereby enhancing customer satisfaction and loyalty. The insuretech market is thus positioned to benefit from this growing trend, as companies strive to meet the diverse needs of their clientele.