Emergence of Data Analytics

Data analytics is becoming a cornerstone of the insuretech market in Germany, enabling companies to leverage vast amounts of information for better decision-making. By November 2025, it is estimated that over 60% of insuretech firms are utilizing advanced analytics to assess risk and personalize offerings. This capability allows insurers to tailor products to individual customer profiles, enhancing customer satisfaction and retention. Moreover, the integration of predictive analytics is expected to reduce claims costs by up to 20%, thereby improving profitability for insurers. As data-driven insights become increasingly vital, the ability to harness analytics will likely differentiate successful players in the insuretech market from their competitors, driving further innovation and efficiency.

Investment in Cybersecurity

As the insuretech market in Germany continues to expand, the importance of cybersecurity cannot be overstated. With the increasing digitization of insurance services, the risk of cyber threats has escalated, prompting companies to invest heavily in robust cybersecurity measures. By 2025, it is projected that spending on cybersecurity solutions within the insuretech sector will surpass €500 million. This investment is essential not only for protecting sensitive customer data but also for maintaining consumer trust in digital insurance platforms. Insurers that prioritize cybersecurity are likely to gain a competitive edge, as consumers become more aware of data privacy issues. Consequently, the focus on cybersecurity is a critical driver for the sustainable growth of the insuretech market in Germany.

Regulatory Support for Innovation

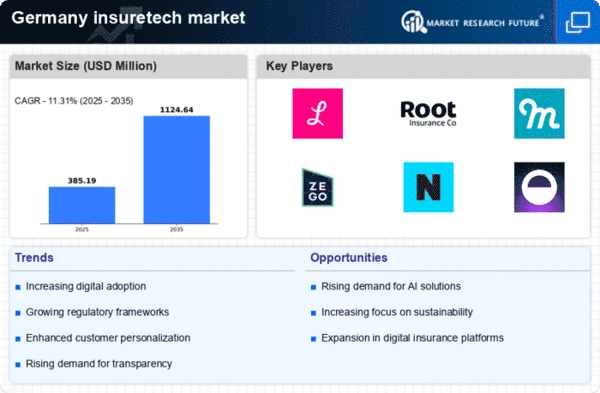

The insuretech market in Germany benefits from a regulatory environment that encourages innovation. The Federal Financial Supervisory Authority (BaFin) has implemented frameworks that facilitate the entry of new technologies and business models. This regulatory support is crucial as it fosters a competitive landscape, allowing startups to thrive alongside traditional insurers. In 2025, the number of insuretech startups in Germany is projected to reach over 300, indicating a robust growth trajectory. The proactive stance of regulators not only enhances consumer trust but also stimulates investment in the insuretech sector, which is expected to exceed €1 billion in funding by the end of the year. This supportive regulatory framework is a key driver for the evolution of the insuretech market, enabling companies to innovate and adapt to changing consumer needs.

Consumer Demand for Digital Solutions

In Germany, there is a marked shift in consumer preferences towards digital solutions in the insuretech market. As of November 2025, approximately 70% of consumers express a preference for managing their insurance policies online, reflecting a broader trend towards digitalization. This demand is driven by the desire for convenience, transparency, and efficiency in insurance transactions. Insurers are responding by investing in user-friendly platforms and mobile applications that enhance customer experience. The growing reliance on digital channels is likely to reshape the competitive landscape, compelling traditional insurers to adapt or risk losing market share. Furthermore, the increasing penetration of smartphones and high-speed internet access in Germany supports this trend, making digital solutions more accessible to a wider audience.

Collaboration with Technology Providers

Collaboration between traditional insurers and technology providers is emerging as a vital driver in the insuretech market in Germany. Partnerships with tech firms enable insurers to access cutting-edge technologies such as artificial intelligence, blockchain, and IoT, which can enhance operational efficiency and customer engagement. As of November 2025, it is estimated that over 40% of insurance companies in Germany have formed strategic alliances with tech startups to co-develop innovative solutions. This trend not only accelerates the pace of innovation but also allows insurers to remain competitive in a rapidly evolving market. The collaborative approach is likely to lead to the development of new products and services that better meet the needs of consumers, thereby driving growth in the insuretech market.