Rising Adoption of Smart Technologies

The proliferation of smart technologies in China is significantly influencing the gpon technology market. As consumers and businesses increasingly adopt smart devices, the demand for high-speed internet connectivity intensifies. Smart homes, smart cities, and industrial automation require robust and reliable internet infrastructure, which gpon technology can provide. The market is projected to grow as more households and enterprises seek to integrate smart solutions, with estimates suggesting a potential increase in market size by over 25% in the next five years. This trend indicates a shift towards more interconnected environments, where gpon technology plays a crucial role in ensuring seamless connectivity and data transmission. The gpon technology market is thus likely to experience a surge in demand driven by the need for efficient and high-capacity networks.

Competitive Landscape and Market Innovation

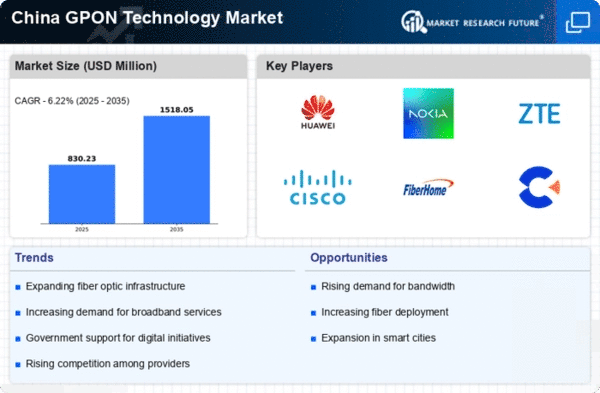

The competitive landscape within the gpon technology market is evolving, with numerous players striving to innovate and capture market share. Companies are investing in research and development to enhance their offerings, leading to the introduction of advanced gpon solutions that cater to diverse consumer needs. This innovation is crucial in a market where differentiation is key to attracting customers. The gpon technology market is witnessing a surge in partnerships and collaborations aimed at leveraging technological advancements. As competition intensifies, it is anticipated that the market will experience a growth rate of approximately 15% over the next few years, driven by the introduction of new products and services that enhance user experience and network performance.

Demand for Enhanced Data Transmission Speeds

As data consumption continues to rise in China, the demand for enhanced data transmission speeds is becoming increasingly critical. The gpon technology market is well-positioned to address this need, as it offers superior bandwidth capabilities compared to traditional copper networks. With the average internet speed in urban areas reaching approximately 100 Mbps, there is a growing expectation for even faster connections. This trend is likely to drive investments in gpon technology, as service providers seek to upgrade their networks to meet consumer demands. The gpon technology market is expected to see a significant uptick in deployment activities, with projections indicating a potential market growth of around 20% in the coming years, driven by the need for faster and more reliable internet services.

Government Support for Digital Infrastructure

The Chinese government has been actively promoting the development of digital infrastructure, which is a key driver for the gpon technology market. Initiatives aimed at enhancing broadband access and digital services are being implemented across the country. The government has set ambitious targets to increase fiber-optic coverage, with plans to connect over 90% of households to high-speed internet by 2025. This commitment is expected to inject substantial investment into the gpon technology market, fostering innovation and expansion. The gpon technology market stands to gain from these government initiatives, as they create a conducive environment for the deployment of advanced fiber-optic networks. The anticipated growth in infrastructure spending could lead to a market increase of approximately 30% over the next few years.

Increasing Urbanization and Connectivity Needs

The rapid urbanization in China is driving the demand for enhanced connectivity solutions, particularly in metropolitan areas. As urban populations grow, the need for reliable and high-speed internet access becomes paramount. The gpon technology market is poised to benefit from this trend, as it offers the necessary infrastructure to support the increasing number of connected devices and services. With urban areas projected to house over 70% of the population by 2030, the gpon technology market is likely to see substantial growth. This urbanization trend necessitates the deployment of advanced fiber-optic networks, which are essential for meeting the connectivity demands of smart cities and IoT applications. Consequently, the gpon technology market is expected to expand significantly to accommodate these evolving needs.