Surge in Data Consumption

The rapid increase in data consumption in China is a primary driver for the data center-rack market. With the proliferation of digital services, including cloud computing, streaming, and e-commerce, the demand for data storage and processing capabilities has surged. According to recent statistics, data traffic in China is expected to grow by over 30% annually, necessitating the expansion of data centers. This growth compels operators to invest in advanced data center-rack solutions that can accommodate higher densities and improve energy efficiency. As a result, the data center-rack market is likely to experience significant growth, driven by the need to support this escalating data demand.

Emergence of Edge Computing

The rise of edge computing is reshaping the landscape of the data center-rack market in China. As organizations seek to process data closer to the source, the demand for localized data centers is increasing. This trend necessitates the deployment of compact and efficient rack solutions that can be integrated into edge environments. The market for edge computing infrastructure is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 30%. Consequently, the data center-rack market is likely to adapt to these emerging requirements, focusing on innovative designs that support edge computing applications.

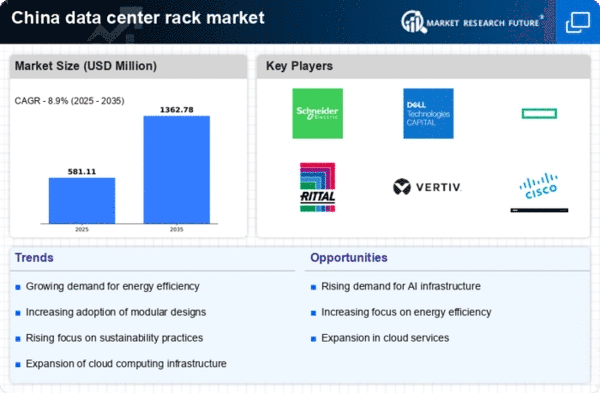

Expansion of Cloud Services

The expansion of cloud services in China is significantly influencing the data center-rack market. As businesses increasingly migrate to cloud-based solutions, the demand for robust data center infrastructure is intensifying. Major cloud service providers are investing heavily in data center facilities, which in turn drives the need for high-capacity racks. Market analysis suggests that the cloud computing sector in China could grow by over 35% in the coming years, further stimulating the data center-rack market. This trend indicates a shift towards scalable and flexible rack solutions that can accommodate the dynamic needs of cloud environments.

Shift Towards Energy Efficiency

Energy efficiency has become a critical focus for data center operators in China, driven by rising energy costs and environmental regulations. The data center-rack market is responding to this trend by offering solutions that optimize power usage and reduce carbon footprints. Innovations such as advanced cooling technologies and energy-efficient rack designs are gaining traction. Reports indicate that energy-efficient racks can reduce power consumption by up to 40%, making them an attractive option for operators. This shift towards sustainability is likely to propel the data center-rack market, as companies prioritize eco-friendly solutions to meet regulatory requirements and corporate social responsibility goals.

Government Initiatives and Investments

The Chinese government has been actively promoting the development of data centers as part of its broader digital economy strategy. Initiatives aimed at enhancing infrastructure and providing financial incentives for technology investments are likely to bolster the data center-rack market. For instance, the government has allocated substantial funding to support the construction of data centers in key regions, which is expected to increase the demand for efficient and scalable rack solutions. This supportive regulatory environment may lead to a projected growth rate of around 25% in the data center-rack market over the next few years, as companies seek to align with national objectives.