Rising Data Consumption

The data center rack market is experiencing a notable surge due to the increasing consumption of data across various sectors. With the proliferation of digital services, the demand for data storage and processing capabilities has escalated. Reports indicate that data traffic in Germany is projected to grow by approximately 30% annually, necessitating the expansion of data center infrastructure. This growth compels operators to invest in advanced rack solutions that can accommodate higher densities and improve operational efficiency. Consequently, the rising data consumption is a critical driver for the data center-rack market, as companies seek to enhance their capabilities to manage and store vast amounts of information.

Emergence of Edge Computing

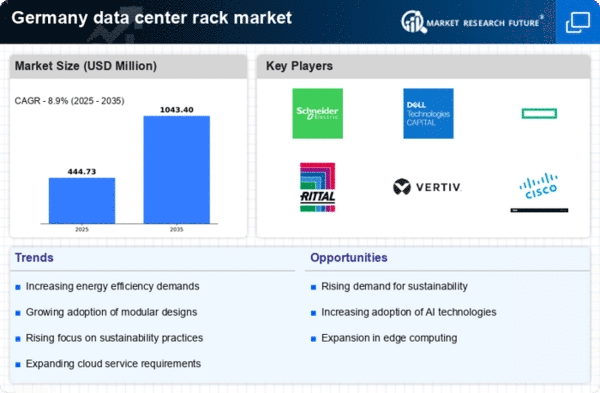

The rise of edge computing is emerging as a transformative force within the data center-rack market in Germany. As businesses seek to process data closer to the source, the need for localized data centers and racks is becoming more pronounced. This trend is driven by the demand for low-latency processing and real-time data analytics, particularly in sectors such as manufacturing and transportation. The edge computing market is projected to grow by 20% annually, which could lead to a corresponding increase in the demand for specialized racks designed for edge environments. Consequently, the emergence of edge computing is likely to be a significant driver for the data center-rack market.

Shift Towards Hybrid Cloud Solutions

The transition towards hybrid cloud solutions is reshaping the data center rack market. Organizations are increasingly adopting hybrid models to balance on-premises and cloud resources, which necessitates the deployment of versatile rack systems. This shift is expected to drive the market as companies seek to optimize their IT infrastructure for flexibility and scalability. According to industry estimates, the hybrid cloud market in Germany is anticipated to grow by 25% over the next few years, further propelling the demand for innovative rack solutions that can seamlessly integrate with both cloud and on-premises environments.

Focus on Data Security and Compliance

Data security and compliance are paramount concerns for organizations operating in Germany, significantly impacting the data center-rack market. With stringent regulations such as the General Data Protection Regulation (GDPR), companies are compelled to invest in secure data storage solutions. This focus on compliance drives the demand for specialized racks that offer enhanced security features, such as advanced locking mechanisms and monitoring systems. As organizations prioritize data protection, the data center-rack market is likely to see increased investments in security-focused rack designs, ensuring that they meet regulatory requirements while maintaining operational efficiency.

Government Initiatives for Digital Infrastructure

In Germany, government initiatives aimed at enhancing digital infrastructure are significantly influencing the data center-rack market. The German government has committed substantial investments, estimated at €1 billion, to bolster the digital economy and improve connectivity. These initiatives are designed to support the establishment of more data centers, which in turn drives the demand for efficient rack solutions. As the government promotes digital transformation across industries, the data center-rack market is likely to benefit from increased funding and support, fostering innovation and growth within the sector.