Rising Cyber Threats

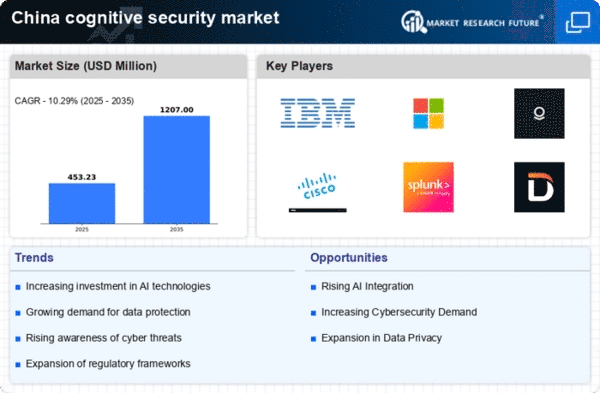

The increasing frequency and sophistication of cyber threats in China is a primary driver for the cognitive security market. As organizations face advanced persistent threats, the demand for cognitive security solutions that leverage AI and machine learning to detect and respond to these threats is surging. In 2025, it is estimated that cybercrime could cost the Chinese economy over $1 trillion, prompting businesses to invest heavily in cognitive security technologies. This market is expected to grow at a CAGR of approximately 20% over the next five years, reflecting the urgent need for enhanced security measures. The cognitive security market is thus positioned to play a crucial role in safeguarding sensitive data and maintaining operational integrity against evolving cyber risks.

Growing Data Volume and Complexity

The exponential growth of data generated by businesses in China is a significant driver for the cognitive security market. With the rise of IoT devices and digital transformation, organizations are inundated with vast amounts of data, making traditional security measures inadequate. Cognitive security solutions, which utilize AI to analyze and interpret complex data patterns, are becoming essential for effective threat detection and response. In 2025, it is projected that data generation in China will reach 50 zettabytes, necessitating advanced cognitive security measures to protect sensitive information. The cognitive security market is thus poised to expand as companies seek innovative ways to manage and secure their data assets.

Increased Awareness of Security Risks

There is a growing awareness among Chinese enterprises regarding the potential risks associated with inadequate cybersecurity measures. High-profile data breaches and security incidents have heightened concerns, leading organizations to prioritize investments in cognitive security solutions. Surveys indicate that over 70% of businesses in China recognize the need for advanced security technologies to mitigate risks. This shift in mindset is driving demand for cognitive security market offerings, as companies seek to enhance their security posture and protect their reputations. The cognitive security market is likely to see accelerated growth as organizations increasingly adopt proactive security strategies to address these emerging threats.

Government Initiatives and Investments

The Chinese government is actively promoting the development of advanced security technologies, including cognitive security solutions. Initiatives aimed at enhancing national cybersecurity infrastructure are driving investments in this sector. The government has allocated substantial funding, with reports indicating an increase of over 30% in budgetary provisions for cybersecurity in 2025. This financial support is likely to stimulate innovation and adoption of cognitive security technologies across various sectors, including finance, healthcare, and critical infrastructure. The cognitive security market stands to benefit significantly from these initiatives, as organizations seek to align with government standards and leverage state-of-the-art security solutions.

Advancements in AI and Machine Learning

Technological advancements in AI and machine learning are significantly influencing the cognitive security market in China. These innovations enable the development of sophisticated security solutions capable of real-time threat detection and automated response. As AI technologies continue to evolve, they provide enhanced capabilities for identifying anomalies and predicting potential security breaches. In 2025, the market for AI-driven security solutions is expected to grow by over 25%, reflecting the increasing reliance on cognitive security technologies. The cognitive security market is thus benefiting from these advancements, as organizations seek to leverage cutting-edge technologies to bolster their cybersecurity defenses.