Rising Demand for Data Analytics

The increasing need for data-driven decision-making is propelling the big data-as-a-service market in China. Organizations across various sectors are recognizing the value of analytics in enhancing operational efficiency and customer engagement. According to recent estimates, the data analytics market in China is projected to reach approximately $30 billion by 2026, indicating a robust growth trajectory. This demand is further fueled by the proliferation of IoT devices and the subsequent generation of vast amounts of data. As businesses seek to harness this data for strategic insights, the big data-as-a-service market is likely to experience significant expansion by providing scalable solutions that cater to diverse analytical needs.

Government Initiatives and Support

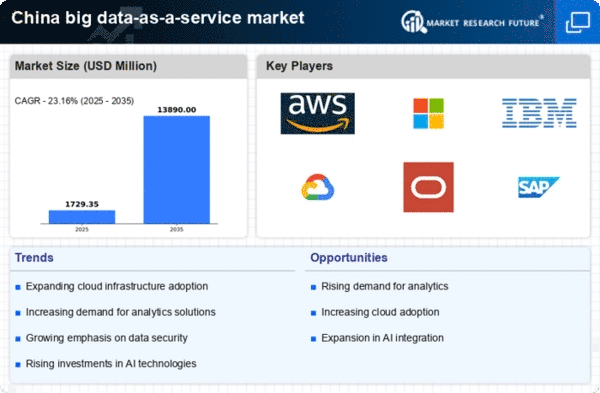

The Chinese government is actively promoting the digital economy, which includes substantial investments in big data infrastructure. Initiatives aimed at enhancing data sharing and collaboration among enterprises are likely to bolster the big data-as-a-service market. For instance, the government has set ambitious targets for the development of smart cities, which rely heavily on data analytics for urban planning and management. This supportive regulatory environment is expected to drive innovation and adoption of big data solutions, with the market projected to grow at a CAGR of around 25% over the next few years. Such initiatives not only enhance the capabilities of businesses but also create a conducive ecosystem for the big data-as-a-service market.

Emergence of Industry-Specific Solutions

The big data-as-a-service market is witnessing a trend towards the development of industry-specific solutions tailored to meet unique business needs. Sectors such as healthcare, finance, and retail are increasingly adopting customized data services to enhance their operational capabilities. For example, the healthcare sector in China is leveraging big data to improve patient outcomes and streamline operations, with the market for healthcare analytics is expected to reach $10 billion by 2025.. This trend indicates a shift towards specialized services that address the complexities of different industries, thereby driving growth in the big data-as-a-service market. Such tailored solutions are likely to attract more enterprises seeking to optimize their data utilization.

Growing Focus on Real-Time Data Processing

As businesses strive for agility and responsiveness, the demand for real-time data processing solutions is on the rise. The big data-as-a-service market is adapting to this need by offering platforms that enable organizations to analyze data as it is generated. This capability is particularly crucial for sectors like finance and e-commerce, where timely insights can significantly impact decision-making. the market for real-time analytics in China is expected to grow substantially, with estimates suggesting a CAGR of over 30% from 2025 onwards. This shift towards real-time capabilities is likely to enhance the competitive edge of businesses, further propelling the growth of the big data-as-a-service market.

Increased Investment in Data Infrastructure

Investment in data infrastructure is a critical driver for the big data-as-a-service market in China. Companies are increasingly allocating resources to upgrade their data storage and processing capabilities to handle the growing volume of data. This trend is supported by the rise of cloud computing, which offers scalable and cost-effective solutions for data management. Recent reports indicate that the cloud infrastructure market in China is projected to exceed $20 billion by 2025, reflecting a strong commitment to enhancing data capabilities. Such investments not only improve operational efficiency but also facilitate the adoption of big data services, thereby driving growth in the big data-as-a-service market.