Increased Focus on Cost Efficiency

Cost efficiency remains a critical consideration for businesses in the UK, particularly in the context of data management. The big data-as-a-service market is benefiting from this focus, as organisations seek to reduce operational costs while maintaining high-quality data services. By outsourcing data management to service providers, companies can avoid the substantial capital expenditures associated with building and maintaining in-house infrastructure. This shift is reflected in the market, where the adoption of big data-as-a-service solutions is projected to increase by approximately 30% over the next five years. Furthermore, the pay-as-you-go model offered by many providers allows businesses to scale their data services according to their needs, further enhancing cost efficiency. As a result, the big data-as-a-service market is likely to see continued growth as organisations prioritise financial prudence in their data strategies.

Growing Demand for Real-Time Analytics

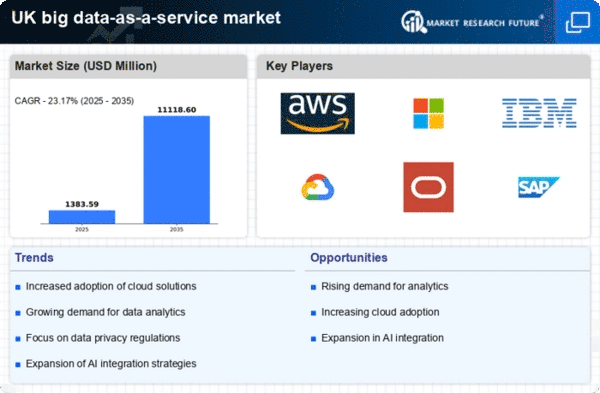

The increasing need for real-time data analysis is a primary driver in the big data-as-a-service market. Businesses across various sectors in the UK are seeking to leverage real-time insights to enhance decision-making processes. This demand is reflected in the market, which is projected to grow at a CAGR of approximately 25% from 2025 to 2030. Companies are investing in big data solutions to gain a competitive edge, as timely data can significantly influence operational efficiency and customer satisfaction. The ability to process and analyze vast amounts of data in real-time allows organisations to respond swiftly to market changes, thereby driving the growth of the big data-as-a-service market. As a result, service providers are increasingly focusing on developing robust platforms that facilitate real-time analytics, further propelling market expansion.

Emergence of Advanced Data Governance Practices

The emergence of advanced data governance practices is shaping the big data-as-a-service market in the UK. As organisations grapple with the complexities of data management, the need for robust governance frameworks has become apparent. Effective data governance ensures compliance with regulations and enhances data quality, which is crucial for informed decision making. In the UK, businesses are increasingly adopting big data-as-a-service solutions to implement these governance practices efficiently. The market is expected to grow as organisations recognise the importance of maintaining data integrity and security. Furthermore, the integration of automated governance tools within big data services is likely to streamline compliance processes, making it easier for companies to adhere to regulatory requirements. This trend indicates a growing awareness of the need for comprehensive data governance in the big data-as-a-service market.

Expansion of Internet of Things (IoT) Ecosystem

The rapid expansion of the Internet of Things (IoT) ecosystem is significantly influencing the big data-as-a-service market. As more devices become interconnected, the volume of data generated is increasing exponentially. In the UK, it is estimated that the number of connected devices will reach over 50 billion by 2030, creating a substantial demand for data management solutions. This surge in data necessitates advanced analytics and storage capabilities, which big data-as-a-service providers are well-positioned to offer. The ability to process and analyse data from diverse IoT sources allows businesses to derive actionable insights, enhancing operational efficiency and innovation. As organisations continue to adopt IoT technologies, the reliance on big data-as-a-service solutions is likely to grow, driving market development and encouraging service providers to innovate their offerings.

Rising Importance of Data-Driven Decision Making

In the current business landscape, the emphasis on data-driven decision making is becoming increasingly pronounced. The big data-as-a-service market is experiencing growth as organisations recognise the value of data in shaping strategies and operations. According to recent studies, companies that adopt data-driven approaches are 5 times more likely to make faster decisions than their competitors. This trend is particularly evident in the UK, where businesses are utilising big data services to enhance their analytical capabilities. The ability to harness data effectively enables organisations to identify trends, optimise processes, and improve customer engagement. Consequently, the demand for big data-as-a-service solutions is expected to rise, as firms seek to integrate advanced analytics into their operations, thereby fostering a culture of informed decision making.