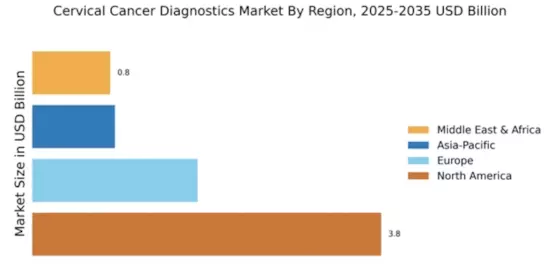

North America : Market Leader in Diagnostics

North America is poised to maintain its leadership in the Cervical Cancer Diagnostics Market, holding a significant market share of $3.8 billion as of 2024. The region's growth is driven by increasing awareness of cervical cancer screening, advancements in diagnostic technologies, and supportive regulatory frameworks. The demand for innovative diagnostic solutions is further fueled by government initiatives aimed at improving women's health outcomes and reducing cervical cancer incidence rates.

The United States stands out as the leading country in this market, with major players like Roche, Abbott, and Hologic driving competition and innovation. The presence of established healthcare infrastructure and a high prevalence of cervical cancer screening programs contribute to the region's robust market dynamics. Additionally, partnerships between key players and healthcare providers enhance the availability of advanced diagnostic tools, ensuring that North America remains at the forefront of cervical cancer diagnostics.

Europe : Emerging Regulatory Frameworks

Europe is witnessing a growing Cervical Cancer Diagnostics Market, valued at $1.8 billion in 2024. The region's growth is significantly influenced by evolving regulatory frameworks and increased funding for cancer screening programs. Countries are implementing policies to enhance early detection and treatment, which is expected to drive demand for advanced diagnostic technologies. The emphasis on preventive healthcare and public awareness campaigns further supports market expansion across Europe.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring key players like Qiagen and Siemens Healthineers. The presence of innovative diagnostic solutions and a strong focus on research and development contribute to the region's growth. Collaborative efforts between government bodies and private sectors are enhancing the accessibility of cervical cancer diagnostics, ensuring that Europe remains a vital player in this field.

Asia-Pacific : Rapidly Growing Market Potential

The Asia-Pacific region is emerging as a significant player in the Cervical Cancer Diagnostics Market, with a market size of $0.9 billion in 2024. The growth is driven by increasing healthcare investments, rising awareness about cervical cancer, and the implementation of national screening programs. Governments are focusing on improving healthcare access and affordability, which is expected to boost demand for diagnostic solutions in the coming years. The region's diverse population and varying healthcare needs present unique opportunities for market expansion.

Countries like China and India are leading the charge, with a growing number of healthcare facilities adopting advanced diagnostic technologies. The competitive landscape includes key players such as BD and Thermo Fisher Scientific, who are actively working to enhance their market presence. The collaboration between public health initiatives and private sector innovations is crucial for addressing the rising cervical cancer burden in this region, making it a focal point for future growth.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is gradually developing its Cervical Cancer Diagnostics Market, valued at $0.85 billion in 2024. The growth is primarily driven by increasing awareness of cervical cancer and the need for improved healthcare infrastructure. Governments are beginning to recognize the importance of early detection and are implementing initiatives to enhance screening programs. However, challenges such as limited access to healthcare facilities and varying levels of public awareness remain significant barriers to market growth.

Countries like South Africa and Kenya are leading the market, with efforts to improve diagnostic capabilities and increase access to screening. The competitive landscape is characterized by the presence of both local and international players, including Genomic Health. Collaborative efforts between governments and NGOs are essential for addressing the cervical cancer burden, making this region a potential growth area for diagnostics in the coming years.