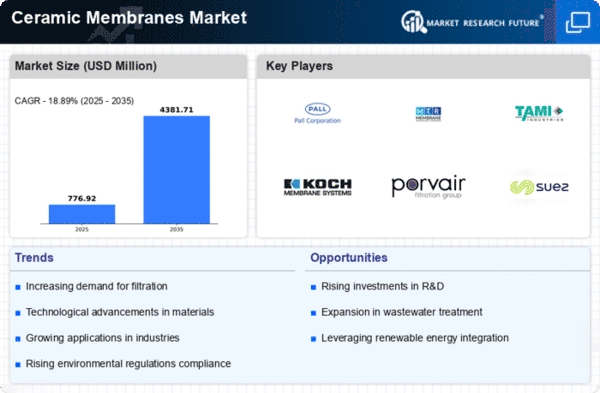

Market Growth Projections

The Global Ceramic Membranes Market Industry is characterized by robust growth projections, with anticipated market values reaching 12.2 USD Billion in 2024 and 34.2 USD Billion by 2035. This growth trajectory is underpinned by a compound annual growth rate of 9.87% from 2025 to 2035. The increasing demand for efficient filtration solutions across various sectors, coupled with technological advancements and stringent environmental regulations, contributes to this positive outlook. As industries seek to enhance operational efficiency and sustainability, the adoption of ceramic membranes is likely to accelerate, positioning the market for continued expansion in the foreseeable future.

Growing Environmental Regulations

The Global Ceramic Membranes Market Industry is significantly influenced by the tightening of environmental regulations across various sectors. Governments are implementing stringent policies aimed at reducing pollution and promoting sustainable practices. Ceramic membranes, known for their efficiency in removing harmful substances from wastewater, align well with these regulatory frameworks. Industries such as oil and gas, pharmaceuticals, and food processing are increasingly adopting ceramic membranes to comply with environmental standards. This shift not only enhances operational efficiency but also mitigates environmental impact, thereby driving market growth. The emphasis on sustainability is expected to sustain the market's upward trajectory in the coming years.

Rising Demand for Water Treatment Solutions

The Global Ceramic Membranes Market Industry experiences a notable surge in demand for advanced water treatment solutions. As urbanization accelerates, the need for efficient wastewater management and potable water production intensifies. Ceramic membranes offer superior filtration capabilities, ensuring the removal of contaminants and pathogens. This trend is underscored by the projected market value of 12.2 USD Billion in 2024, reflecting a growing recognition of ceramic membranes' role in sustainable water management. Governments worldwide are increasingly investing in infrastructure projects aimed at enhancing water quality, further propelling the adoption of ceramic membrane technologies.

Expanding Applications in Industrial Processes

The versatility of ceramic membranes is a key driver for the Global Ceramic Membranes Market Industry, as they find applications across diverse industrial processes. Industries such as chemical manufacturing, food and beverage, and pharmaceuticals are increasingly utilizing ceramic membranes for filtration, separation, and purification. Their ability to withstand harsh conditions and provide high-quality outputs makes them a preferred choice. The market's expansion is further supported by the anticipated compound annual growth rate of 9.87% from 2025 to 2035, indicating a robust growth trajectory. This trend suggests that ceramic membranes will continue to play a crucial role in enhancing process efficiencies across various sectors.

Increased Investment in Research and Development

Investment in research and development is a driving force behind the Global Ceramic Membranes Market Industry. Companies are allocating significant resources to innovate and improve ceramic membrane technologies. This focus on R&D aims to enhance membrane performance, reduce production costs, and expand application areas. Collaborative efforts between industry players and research institutions are fostering breakthroughs in membrane design and functionality. As a result, the market is poised for substantial growth, with projections indicating a value of 34.2 USD Billion by 2035. This investment in innovation not only strengthens competitive positioning but also addresses emerging challenges in filtration and separation technologies.

Technological Advancements in Membrane Manufacturing

Technological innovations play a pivotal role in shaping the Global Ceramic Membranes Market Industry. Recent advancements in membrane fabrication techniques have led to the development of more efficient and durable ceramic membranes. These innovations enhance performance characteristics such as permeability and selectivity, making ceramic membranes more attractive for various applications, including food and beverage processing, pharmaceuticals, and industrial wastewater treatment. As a result, the market is expected to grow significantly, with projections indicating a value of 34.2 USD Billion by 2035. This growth is likely driven by the increasing adoption of advanced materials and manufacturing processes that improve membrane functionality.