E-commerce Growth

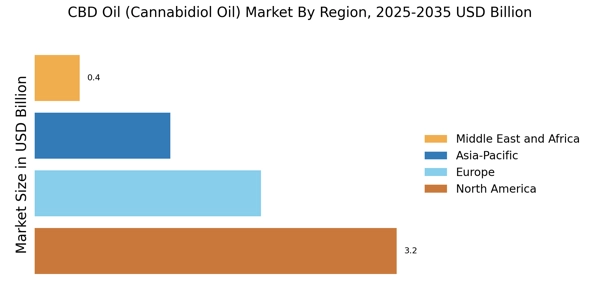

The rise of e-commerce is significantly influencing the CBD Oil Market, providing consumers with convenient access to a wide range of CBD products. Online shopping platforms are becoming increasingly popular for purchasing CBD oil, as they offer a level of discretion and variety that traditional retail may not provide. Data indicates that online sales of CBD products are expected to grow at a rate of 25% annually, reflecting a shift in consumer purchasing behavior. This trend is further supported by the proliferation of digital marketing strategies that effectively reach target audiences. As more consumers turn to online channels for their CBD oil needs, businesses are likely to adapt by enhancing their online presence and optimizing their e-commerce strategies. Consequently, the CBD Oil Market is poised to benefit from this digital transformation, potentially leading to increased sales and market penetration.

Regulatory Developments

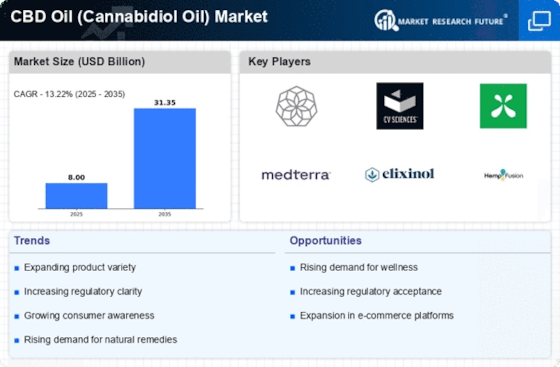

The evolving regulatory landscape surrounding CBD products is a critical driver for the CBD Oil Market. Recent legislative changes in various regions have begun to clarify the legal status of CBD oil, which could potentially enhance market stability and consumer confidence. For instance, the removal of hemp-derived CBD from the controlled substances list in several jurisdictions has opened new avenues for market growth. This regulatory clarity is expected to encourage more businesses to enter the CBD oil market, thereby increasing competition and innovation. Additionally, as regulations become more standardized, consumers may feel more secure in their purchasing decisions, leading to a broader acceptance of CBD oil products. The ongoing dialogue among policymakers and industry stakeholders suggests that further regulatory advancements could significantly impact the CBD Oil Market in the coming years.

Diverse Product Offerings

The CBD Oil Market is characterized by an expanding array of product offerings, catering to a wide range of consumer preferences and needs. From tinctures and capsules to edibles and topicals, the variety of CBD-infused products is growing rapidly. This diversification is likely to attract a broader customer base, as different demographics seek tailored solutions for their health concerns. Market data indicates that the edibles segment is projected to grow at a compound annual growth rate of over 20% in the next five years, reflecting a shift in consumer preferences towards more palatable forms of CBD. Furthermore, the introduction of innovative formulations and flavors is enhancing the appeal of CBD products, thereby driving sales. As manufacturers continue to innovate, the CBD Oil Market is poised for sustained growth, with an emphasis on meeting diverse consumer demands.

Increasing Consumer Awareness

The CBD Oil Market is experiencing a notable surge in consumer awareness regarding the potential health benefits of CBD oil. As individuals become more informed about the therapeutic properties of CBD, there is a growing inclination towards natural alternatives for health and wellness. This heightened awareness is likely to drive demand, as consumers actively seek products that align with their health goals. Reports indicate that approximately 60% of consumers are now aware of CBD's potential benefits, which could lead to increased sales in the CBD oil sector. Furthermore, educational campaigns and social media influence are playing pivotal roles in shaping consumer perceptions, thereby fostering a more informed market. As awareness continues to expand, the CBD Oil Market may witness a significant uptick in both new and repeat customers.

Integration of CBD in Wellness Trends

The integration of CBD oil into broader wellness trends is emerging as a significant driver for the CBD Oil Market. As consumers increasingly prioritize holistic health approaches, CBD oil is being recognized for its potential to complement various wellness practices. This trend is particularly evident in the rise of CBD-infused wellness products, such as skincare and dietary supplements, which are gaining traction among health-conscious individuals. Market Research Future suggests that the wellness sector is expanding rapidly, with CBD products expected to capture a substantial share of this growth. Additionally, the alignment of CBD oil with lifestyle trends, such as mindfulness and self-care, is likely to enhance its market appeal. As the wellness movement continues to evolve, the CBD Oil Market may benefit from increased consumer interest and investment in CBD-related products.