Expansion of Distribution Channels

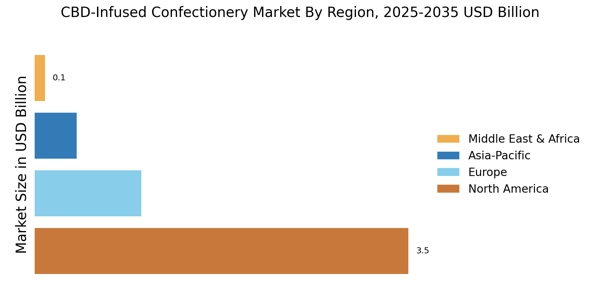

The CBD-Infused Confectionery Market is benefiting from the expansion of distribution channels, which is facilitating greater accessibility for consumers. Retailers are increasingly incorporating CBD-infused products into their offerings, ranging from specialty health stores to mainstream supermarkets. This diversification in distribution not only enhances product visibility but also allows consumers to purchase CBD-infused confections more conveniently. Additionally, the rise of e-commerce platforms has further broadened the reach of these products, enabling consumers to explore a wider variety of options from the comfort of their homes. As distribution channels continue to expand, the CBD-Infused Confectionery Market is poised for growth, as more consumers gain access to these innovative products.

Increased Awareness of CBD Benefits

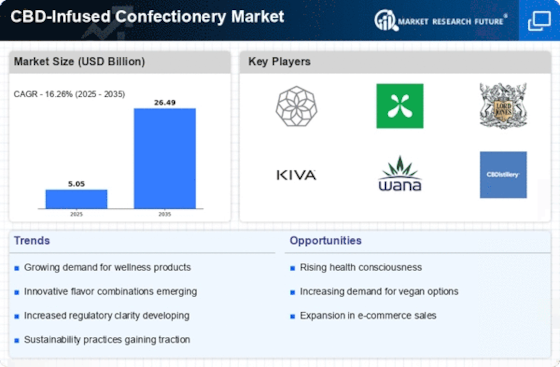

Consumer awareness regarding the potential benefits of CBD is a significant driver for the CBD-Infused Confectionery Market. As educational campaigns and media coverage proliferate, more individuals are becoming informed about the therapeutic properties of CBD, including its potential to alleviate stress, improve sleep quality, and enhance overall well-being. This heightened awareness is translating into increased interest in CBD-infused products, particularly among health-conscious consumers. Market data reveals that a considerable percentage of consumers are actively seeking out CBD-infused confections as part of their wellness routines. Consequently, this trend is likely to propel the growth of the CBD-Infused Confectionery Market, as brands capitalize on the demand for products that align with consumers' health goals.

Legalization and Regulatory Support

The evolving legal landscape surrounding CBD products is a critical driver for the CBD-Infused Confectionery Market. As more regions implement regulations that support the use of CBD in food products, manufacturers are finding new opportunities to enter the market. The recent changes in legislation have led to an increase in consumer confidence, as they are more willing to try CBD-infused confections knowing they are compliant with local laws. This regulatory support is essential for the growth of the market, as it not only legitimizes the products but also encourages investment in research and development. Market analysts suggest that as regulations continue to evolve favorably, the CBD-Infused Confectionery Market could see a substantial increase in product offerings and consumer adoption.

Rising Demand for Natural Ingredients

The CBD-Infused Confectionery Market is experiencing a notable surge in demand for products that incorporate natural ingredients. Consumers are increasingly seeking alternatives to traditional sweets that are perceived as healthier and more beneficial. This trend is driven by a growing awareness of the potential health benefits associated with CBD, such as anxiety relief and pain management. As a result, manufacturers are focusing on creating confectionery items that not only satisfy sweet cravings but also offer therapeutic effects. Market data indicates that the demand for natural and organic products is expected to grow, with a significant portion of consumers willing to pay a premium for CBD-infused options. This shift towards natural ingredients is likely to shape the future of the CBD-Infused Confectionery Market, encouraging innovation and the development of new product lines.

Consumer Preference for Unique Flavors

The CBD-Infused Confectionery Market is witnessing a growing consumer preference for unique and exotic flavors in confectionery products. As consumers seek novel experiences, manufacturers are responding by developing innovative flavor profiles that incorporate CBD. This trend is not only appealing to adventurous eaters but also enhances the overall enjoyment of CBD-infused confections. Market data suggests that products featuring unique flavors are more likely to attract attention and drive sales, as they stand out in a crowded marketplace. This inclination towards flavor innovation is likely to play a pivotal role in shaping the future of the CBD-Infused Confectionery Market, as brands strive to differentiate themselves and capture consumer interest.