Rising E-commerce Demand

The surge in e-commerce activities has led to an increased need for cargo transportation insurance. As online shopping continues to expand, businesses are shipping more goods than ever before, necessitating robust insurance coverage to protect against potential losses. In 2025, the e-commerce sector is projected to reach a valuation of over 6 trillion USD, which directly correlates with the growth of the Cargo Transportation Insurance Market. This trend indicates that as more goods are transported, the demand for insurance solutions that cover various risks associated with cargo transit will likely rise, thereby driving the market forward.

Expansion of International Trade

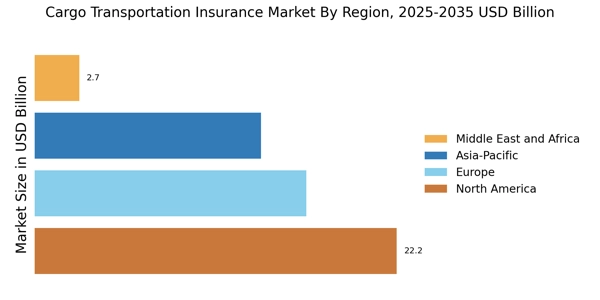

The ongoing expansion of international trade is a pivotal driver for the Cargo Transportation Insurance Market. As countries engage in more cross-border transactions, the volume of goods transported globally increases, leading to a heightened need for insurance coverage. In 2025, the value of global merchandise trade is expected to exceed 25 trillion USD, which underscores the importance of cargo insurance in mitigating risks associated with international shipping. This growth in trade activities suggests that businesses will increasingly seek comprehensive insurance solutions to safeguard their shipments, thereby propelling the market.

Regulatory Compliance Requirements

Regulatory compliance requirements are becoming more stringent, which serves as a key driver for the Cargo Transportation Insurance Market. Governments and international bodies are implementing regulations that mandate insurance coverage for cargo shipments to ensure accountability and safety in transportation. As these regulations evolve, businesses are compelled to secure adequate insurance to comply with legal standards. This trend is expected to contribute to the growth of the cargo insurance market, as companies seek to align their operations with regulatory demands while protecting their interests.

Increased Awareness of Risk Management

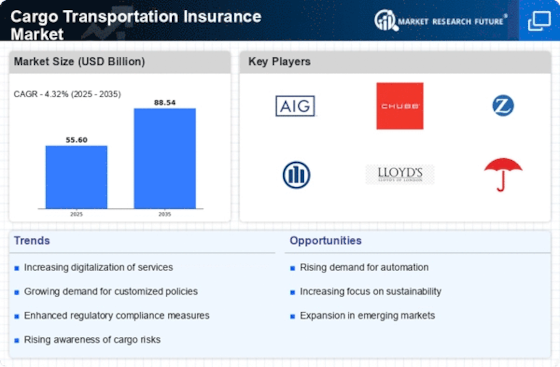

There is a growing awareness among businesses regarding the importance of risk management, which significantly influences the Cargo Transportation Insurance Market. Companies are increasingly recognizing that effective risk management strategies, including comprehensive insurance coverage, are essential for protecting their assets during transit. This heightened awareness is reflected in the rising number of businesses seeking cargo insurance policies. In 2025, it is estimated that the market for cargo insurance will grow by approximately 8% annually, driven by the need for businesses to safeguard their shipments against unforeseen events.

Technological Advancements in Logistics

Technological advancements in logistics and supply chain management are transforming the Cargo Transportation Insurance Market. Innovations such as real-time tracking, blockchain technology, and automated systems enhance the efficiency and transparency of cargo transportation. These technologies not only streamline operations but also reduce the likelihood of losses, which can lead to lower insurance premiums. As companies adopt these technologies, the demand for tailored insurance products that address specific risks associated with modern logistics is likely to increase, thereby fostering growth in the insurance market.