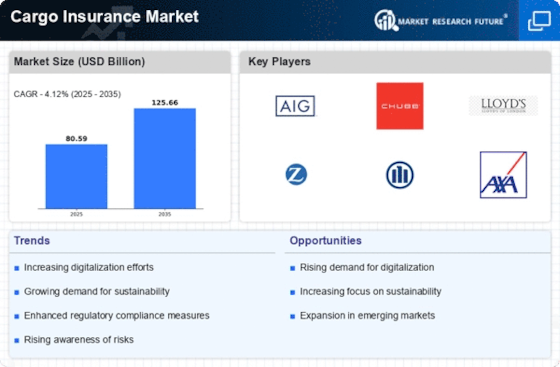

Emerging Markets Growth

Emerging markets are witnessing rapid economic growth, which is significantly impacting the Cargo Insurance Market. As these regions develop, there is an increase in infrastructure investments and trade activities, leading to a higher demand for cargo insurance. For example, countries in Asia and Africa are expanding their manufacturing capabilities and engaging in international trade, necessitating robust insurance solutions to protect their goods. This growth in emerging markets presents a substantial opportunity for the Cargo Insurance Market, as insurers look to cater to the evolving needs of businesses in these regions.

Increasing Trade Volumes

The Cargo Insurance Market is experiencing a notable surge in trade volumes, driven by the expansion of international trade agreements and the growth of e-commerce. As businesses increasingly engage in cross-border transactions, the need for cargo insurance becomes paramount to mitigate risks associated with loss or damage during transit. According to recent data, the value of global merchandise trade is projected to reach trillions of dollars, indicating a robust demand for cargo insurance solutions. This trend suggests that as trade volumes rise, so too will the necessity for comprehensive insurance coverage, thereby propelling the growth of the Cargo Insurance Market.

Technological Advancements

Technological advancements are playing a crucial role in shaping the Cargo Insurance Market. Innovations such as blockchain, IoT, and artificial intelligence are enhancing the efficiency and transparency of cargo tracking and insurance processes. For instance, the integration of IoT devices allows for real-time monitoring of cargo conditions, which can lead to more accurate risk assessments and claims processing. As these technologies become more prevalent, they are expected to streamline operations and reduce costs, thereby attracting more businesses to invest in cargo insurance. This technological evolution suggests a transformative impact on the Cargo Insurance Market.

Regulatory Compliance Requirements

The Cargo Insurance Market is increasingly influenced by stringent regulatory compliance requirements imposed by various governments and international bodies. These regulations often mandate that businesses carry adequate insurance coverage for their cargo, particularly in high-risk sectors such as pharmaceuticals and hazardous materials. As compliance becomes a critical factor for operational legitimacy, companies are compelled to secure cargo insurance to meet these legal obligations. This trend indicates that regulatory frameworks are likely to drive growth in the Cargo Insurance Market, as businesses seek to align with evolving standards.

Rising Awareness of Risk Management

There is a growing recognition among businesses regarding the importance of risk management in the Cargo Insurance Market. Companies are becoming more aware of the potential financial repercussions of cargo loss or damage, leading to an increased uptake of insurance policies. This heightened awareness is further fueled by the complexities of modern supply chains, which can expose businesses to various risks. As organizations strive to protect their assets and ensure business continuity, the demand for cargo insurance is likely to escalate. This trend indicates a shift towards proactive risk management strategies, which could significantly influence the Cargo Insurance Market.