Increased Healthcare Expenditure

Japan's rising healthcare expenditure is a significant factor influencing the cardiac biomarkers market. With a focus on improving healthcare infrastructure and access to advanced medical technologies, the government is investing heavily in healthcare initiatives. This financial commitment is likely to enhance the availability of cardiac biomarker tests, making them more accessible to patients. As healthcare spending is projected to grow by around 5% annually, the cardiac biomarkers market is expected to benefit from increased funding for research, development, and implementation of innovative diagnostic solutions. This trend underscores the importance of cardiac biomarkers in the broader context of healthcare improvement.

Growing Awareness of Heart Health

There is a notable increase in public awareness regarding heart health in Japan, which is driving the cardiac biomarkers market. Educational campaigns and health initiatives aimed at promoting cardiovascular health are encouraging individuals to seek preventive care and regular screenings. This heightened awareness is leading to a greater demand for cardiac biomarker tests, as patients and healthcare providers recognize their value in early detection and management of heart diseases. As a result, the market is likely to experience sustained growth, with estimates suggesting an increase in demand for cardiac biomarkers by approximately 10% over the next few years.

Advancements in Diagnostic Technologies

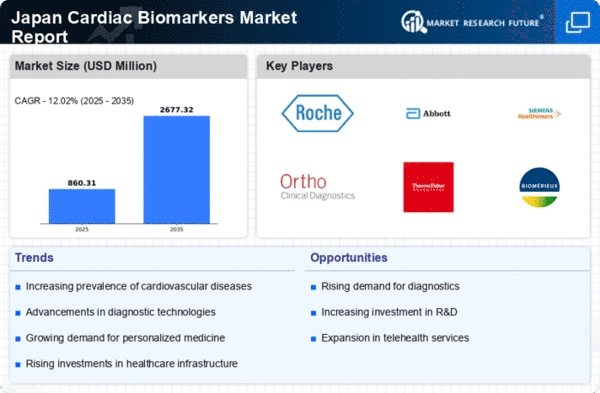

Technological innovations in diagnostic tools are transforming the cardiac biomarkers market. The introduction of high-sensitivity assays and point-of-care testing devices enhances the accuracy and speed of cardiac biomarker detection. These advancements facilitate timely diagnosis and treatment, which is crucial in managing cardiovascular diseases. In Japan, the market for cardiac biomarkers is projected to reach approximately $1.5 billion by 2027, reflecting a growing investment in research and development. The integration of artificial intelligence and machine learning in diagnostic processes further augments the capabilities of cardiac biomarkers, making them indispensable in modern healthcare settings.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases in Japan is a primary driver for the cardiac biomarkers market. According to recent health statistics, cardiovascular diseases account for a significant portion of mortality rates, prompting healthcare providers to seek effective diagnostic tools. The demand for early detection and monitoring of heart conditions is escalating, leading to a greater reliance on cardiac biomarkers. This trend is expected to continue, with projections indicating that the market could grow at a CAGR of approximately 8% over the next few years. As healthcare systems prioritize patient outcomes, to improve cardiovascular health.

Regulatory Support for Biomarker Development

Regulatory bodies in Japan are increasingly supportive of the development and approval of cardiac biomarkers, which is positively impacting the market. Streamlined approval processes and guidelines for biomarker validation are encouraging innovation and facilitating the introduction of new diagnostic tests. This regulatory environment fosters collaboration between researchers, healthcare providers, and industry stakeholders, ultimately enhancing the cardiac biomarkers market. As more biomarkers receive regulatory approval, the market is expected to expand, with a projected growth rate of around 7% annually, reflecting the importance of regulatory frameworks in advancing cardiac health diagnostics.