Corporate Sustainability Goals

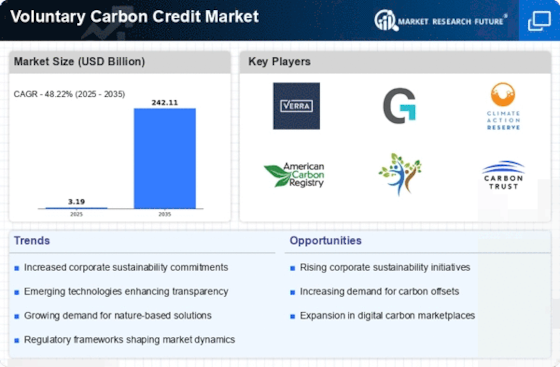

The Voluntary Carbon Credit Market is witnessing a surge in corporate sustainability initiatives. Many organizations are setting ambitious targets to achieve net-zero emissions by 2050, which necessitates the purchase of carbon credits. In 2025, it is projected that over 60% of Fortune 500 companies will have integrated carbon offsetting into their sustainability strategies. This trend indicates a growing recognition of the importance of carbon credits in achieving corporate environmental goals. As companies increasingly prioritize sustainability, the Voluntary Carbon Credit Market is expected to expand, driven by the demand for credible and verifiable carbon offsets.

Regulatory Pressure and Compliance

The Voluntary Carbon Credit Market is increasingly influenced by regulatory frameworks aimed at reducing greenhouse gas emissions. Governments are implementing stricter regulations that compel companies to offset their carbon footprints. This regulatory pressure is driving demand for carbon credits, as organizations seek to comply with environmental standards. In 2025, it is estimated that compliance-related purchases could account for a substantial portion of the voluntary market, potentially reaching 30% of total transactions. As companies strive to meet these regulations, the Voluntary Carbon Credit Market is likely to experience heightened activity, with businesses actively seeking credits to demonstrate their commitment to sustainability.

Investment in Renewable Energy Projects

The Voluntary Carbon Credit Market is significantly influenced by investments in renewable energy projects. As countries and companies strive to transition to low-carbon economies, there is a growing emphasis on funding projects that generate carbon credits through renewable energy initiatives. In 2025, it is projected that investments in renewable energy could lead to the creation of millions of new carbon credits, thereby expanding the Voluntary Carbon Credit Market. This influx of credits will not only support sustainability goals but also provide businesses with more options for offsetting their emissions, further driving market growth.

Consumer Demand for Sustainable Practices

The Voluntary Carbon Credit Market is also being shaped by rising consumer awareness and demand for sustainable practices. Consumers are increasingly favoring brands that demonstrate environmental responsibility, prompting companies to invest in carbon credits as part of their corporate social responsibility efforts. In 2025, it is anticipated that consumer-driven initiatives could lead to a 25% increase in voluntary carbon credit purchases. This shift in consumer behavior is compelling businesses to engage in the Voluntary Carbon Credit Market, as they seek to align their operations with the values of environmentally conscious consumers.

Technological Innovations in Carbon Accounting

Technological advancements are playing a pivotal role in the Voluntary Carbon Credit Market, particularly in the realm of carbon accounting and verification. Innovations such as blockchain technology and artificial intelligence are enhancing the transparency and efficiency of carbon credit transactions. In 2025, it is expected that these technologies will streamline the verification process, making it easier for companies to track their carbon offsets. This increased efficiency may lead to a more robust Voluntary Carbon Credit Market, as businesses gain confidence in the integrity of carbon credits and are more likely to participate in the market.