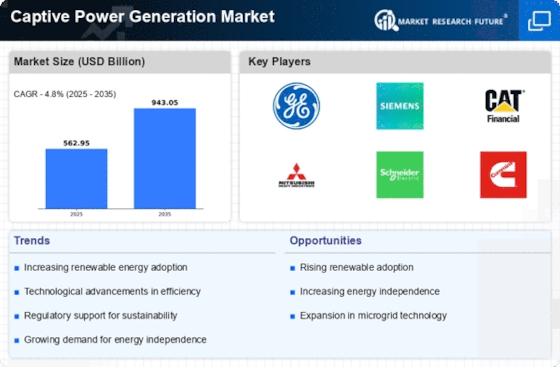

Increasing Energy Demand

The Captive Power Generation Market is experiencing a notable surge in energy demand across various sectors, including manufacturing, mining, and commercial enterprises. This heightened demand is primarily driven by industrial growth and urbanization, which necessitate reliable and uninterrupted power supply. According to recent data, energy consumption in industrial sectors has increased by approximately 3.5% annually, indicating a robust need for self-generated power solutions. Companies are increasingly turning to captive power generation to mitigate risks associated with grid failures and fluctuating energy prices. This trend suggests that businesses are prioritizing energy independence, thereby propelling the growth of the captive power generation market.

Cost Efficiency and Economic Viability

Cost efficiency remains a pivotal driver in the Captive Power Generation Market. Organizations are increasingly recognizing the financial benefits of generating their own power, particularly in regions where electricity tariffs are high. By investing in captive power systems, companies can significantly reduce their operational costs, as they are less susceptible to price volatility in the energy market. Recent analyses indicate that businesses can save up to 30% on energy costs by utilizing captive generation. This economic viability is particularly appealing to sectors with high energy consumption, such as manufacturing and heavy industries, further stimulating the growth of the captive power generation market.

Regulatory Incentives for Self-Generation

Regulatory frameworks are increasingly favoring self-generation, which is a significant driver for the Captive Power Generation Market. Governments are implementing policies that encourage businesses to invest in captive power systems, including tax incentives, subsidies, and streamlined permitting processes. These regulatory incentives are designed to promote energy independence and reduce reliance on traditional grid systems. Recent reports indicate that regions with supportive regulatory environments have seen a 20% increase in captive power installations. This trend suggests that favorable policies are likely to continue driving the growth of the captive power generation market, as businesses seek to capitalize on these opportunities.

Technological Innovations in Power Generation

Technological advancements are reshaping the Captive Power Generation Market, enabling more efficient and sustainable energy solutions. Innovations such as combined heat and power (CHP) systems, advanced energy storage, and smart grid technologies are enhancing the performance and reliability of captive power systems. These technologies not only improve energy efficiency but also facilitate the integration of renewable energy sources, which is becoming increasingly important. The adoption of such technologies is projected to grow, with estimates suggesting a compound annual growth rate of 5% in the next five years. This trend indicates a shift towards more sophisticated energy management practices within the captive power generation market.

Environmental Sustainability and Corporate Responsibility

The growing emphasis on environmental sustainability is influencing the Captive Power Generation Market. Companies are increasingly adopting captive power generation as part of their corporate social responsibility initiatives, aiming to reduce their carbon footprint and enhance their sustainability profiles. The shift towards cleaner energy sources, such as solar and wind, is becoming more pronounced, with many organizations committing to net-zero emissions targets. Data indicates that businesses utilizing renewable captive power solutions can reduce greenhouse gas emissions by up to 50%. This commitment to sustainability not only aligns with consumer expectations but also positions companies favorably in the market, thereby driving the growth of the captive power generation market.