Caps Closures Market Summary

As per Market Research Future analysis, the Caps and Closures Market was estimated at 76.3 USD Billion in 2024. The Caps and Closures industry is projected to grow from 80.0 USD Billion in 2025 to 129.1 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.90% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Caps and Closures Market is experiencing a dynamic shift towards sustainability and innovation.

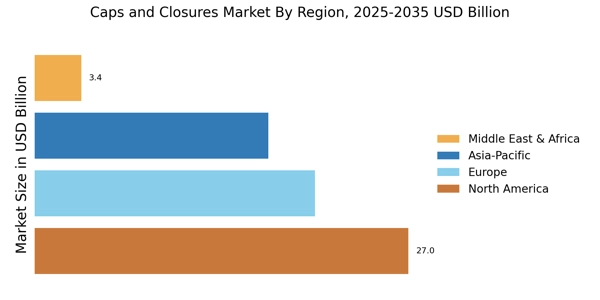

- The North American region remains the largest market for caps and closures, driven by robust consumer demand.

- Asia-Pacific is identified as the fastest-growing region, reflecting increasing urbanization and disposable income.

- Plastic caps continue to dominate the market, while metal closures are emerging as the fastest-growing segment due to their premium appeal.

- Sustainability initiatives and technological innovations are key drivers propelling market growth and shaping future trends.

Market Size & Forecast

| 2024 Market Size | 76.3 (USD Billion) |

| 2035 Market Size | 129.1 (USD Billion) |

| CAGR (2025 - 2035) | 4.90% |

Major Players

Crown Holdings (US), Ball Corporation (US), Amcor (AU), Silgan Holdings (US), Berry Global (US), Graham Packaging (US), Alpla (AT), Mondi Group (GB), AptarGroup (US)