E-commerce Expansion

The candles Market is benefiting from the rapid expansion of e-commerce platforms, which have transformed the way consumers purchase candles. Online shopping offers convenience and a wider selection of products, allowing consumers to explore various brands and styles from the comfort of their homes. In 2025, e-commerce is projected to account for a significant share of the Candles Market, as more consumers turn to online retailers for their candle needs. This shift is likely to encourage brands to enhance their online presence and invest in digital marketing strategies to reach a broader audience. The accessibility of candles through e-commerce channels may also lead to increased sales and brand loyalty.

Rising Demand for Aromatherapy

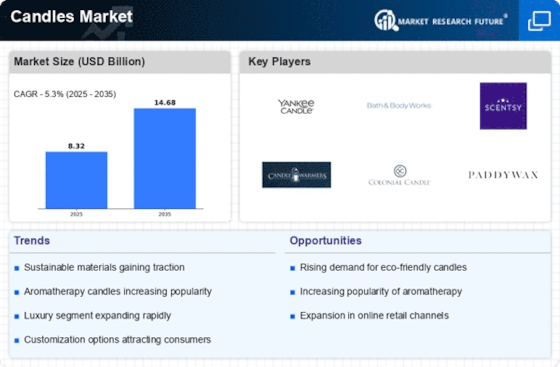

The Candles Market is experiencing a notable increase in demand for aromatherapy products. Consumers are increasingly recognizing the therapeutic benefits of scented candles, which are believed to enhance mood and promote relaxation. This trend is supported by a growing body of research indicating the positive effects of certain scents on mental well-being. In 2025, the aromatherapy segment within the Candles Market is projected to account for a substantial share, driven by consumer preferences for natural and organic ingredients. As more individuals seek holistic approaches to health, the market for aromatherapy candles is likely to expand, presenting opportunities for manufacturers to innovate and diversify their product offerings.

Growth of Home Fragrance Products

The Candles Market is witnessing a significant shift towards home fragrance products, with candles being a primary choice for consumers. The rise in home decor trends has led to an increased focus on creating inviting and pleasant living spaces. In 2025, the home fragrance segment is expected to grow, with candles representing a considerable portion of this market. This growth is fueled by the desire for personalized home environments, where consumers are willing to invest in high-quality, aesthetically pleasing candles. The integration of unique designs and fragrances is likely to enhance the appeal of candles, making them a staple in home fragrance solutions.

Cultural and Seasonal Celebrations

The Candles Market is significantly influenced by cultural and seasonal celebrations, which drive demand for candles during specific times of the year. Events such as holidays, festivals, and religious observances often see a surge in candle sales, as they are commonly used for decoration and ambiance. In 2025, the market is likely to experience seasonal spikes, particularly during festive periods when consumers purchase candles for gifting and home decoration. This cyclical demand presents opportunities for brands to create limited edition products and seasonal collections, catering to the unique preferences associated with various celebrations. The ability to tap into cultural trends may enhance brand visibility and consumer engagement.

Sustainability and Eco-Friendly Products

The Candles Market is increasingly influenced by consumer preferences for sustainability and eco-friendly products. As awareness of environmental issues grows, consumers are seeking candles made from natural, renewable materials, such as soy wax and beeswax. In 2025, the demand for eco-friendly candles is expected to rise, as brands respond to this trend by offering products that align with sustainable practices. This shift not only caters to environmentally conscious consumers but also positions brands favorably in a competitive market. The emphasis on sustainability may drive innovation in candle production, leading to the development of new, eco-friendly formulations and packaging solutions.