Rising Internet Penetration

The video streaming software market in Canada is experiencing a notable surge due to the increasing penetration of high-speed internet. As of 2025, approximately 90% of Canadian households have access to broadband internet, facilitating seamless streaming experiences. This widespread connectivity enables consumers to access a variety of content on-demand, thereby driving the demand for video streaming software. Furthermore, the Canadian Radio-television and Telecommunications Commission (CRTC) indicates that the average internet speed in Canada has reached 150 Mbps, which supports high-definition streaming. Consequently, the growth in internet accessibility is likely to propel the video streaming-software market, as more users engage with diverse platforms and services, enhancing overall market dynamics.

Increased Mobile Device Usage

The proliferation of mobile devices in Canada is significantly impacting the video streaming software market. As of 2025, over 80% of Canadians own smartphones, and a substantial portion of video content is consumed via mobile applications. This trend indicates a shift in viewing habits, with users increasingly favoring on-the-go access to their favorite shows and movies. Consequently, video streaming software developers are prioritizing mobile optimization to enhance user experience and engagement. The Canadian market is also witnessing the development of innovative mobile applications that leverage advanced features such as offline viewing and personalized recommendations. This growing reliance on mobile devices is likely to drive further growth in the video streaming-software market, as companies strive to meet the demands of mobile-centric consumers.

Emergence of Local Content Providers

The video streaming software market in Canada is being shaped by the emergence of local content providers. In recent years, there has been a marked increase in the number of Canadian streaming platforms that focus on regional content, catering to diverse cultural and linguistic demographics. This trend is supported by government initiatives aimed at promoting Canadian content, which has led to a rise in investment in local productions. As of 2025, local streaming services are capturing an estimated 25% of the market share, indicating a growing preference for homegrown content. This shift not only enriches the content landscape but also fosters competition among providers, ultimately benefiting consumers. The presence of local content providers is expected to continue influencing the video streaming-software market, as they offer unique offerings that resonate with Canadian audiences.

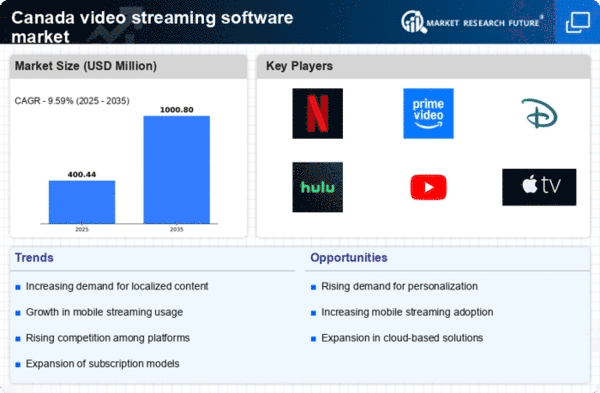

Shift Towards Subscription-Based Models

The video streaming software market in Canada is witnessing a significant shift towards subscription-based revenue models. As of 2025, subscription services account for over 70% of the total revenue generated within the market. This trend is largely driven by consumer preferences for ad-free experiences and exclusive content offerings. Major players in the industry, such as Netflix and Amazon Prime Video, have successfully capitalized on this model, attracting millions of subscribers. Additionally, the Canadian market has seen the emergence of local streaming services that cater to regional content preferences, further diversifying the subscription landscape. This transition to subscription-based models is expected to continue influencing the video streaming-software market, as companies adapt their strategies to meet evolving consumer demands.

Technological Advancements in Streaming Quality

Technological advancements are playing a crucial role in shaping the video streaming software market in Canada. Innovations such as 4K streaming, HDR, and adaptive bitrate streaming are enhancing the quality of video content available to consumers. As of 2025, approximately 40% of Canadian households have access to 4K-capable devices, which is driving demand for high-quality streaming services. Furthermore, the integration of artificial intelligence and machine learning in content delivery systems is optimizing user experiences by providing personalized recommendations and reducing buffering times. These technological improvements are likely to attract more users to the video streaming-software market, as consumers increasingly seek superior viewing experiences. The ongoing evolution of streaming technology is expected to remain a key driver of growth in the market.