Growing Demand for Scalability

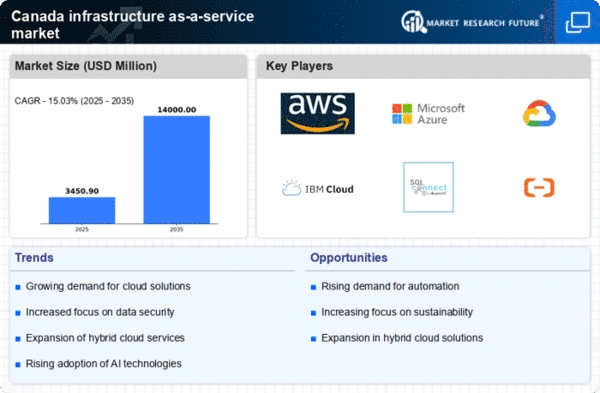

The infrastructure as-a-service market in Canada experiences a notable surge in demand for scalable solutions. Organizations increasingly seek the ability to adjust their IT resources dynamically, responding to fluctuating workloads. This trend is particularly pronounced among small to medium-sized enterprises (SMEs) that require flexibility without the burden of significant capital expenditures. According to recent data, the Canadian market for IaaS is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for scalable infrastructure. As businesses expand, the ability to scale resources up or down efficiently becomes a critical factor in their operational strategy, thereby propelling the infrastructure as-a-service market forward.

Cost Efficiency and Budget Management

Cost efficiency remains a pivotal driver in the infrastructure as-a-service market in Canada. Organizations are increasingly drawn to IaaS solutions as they offer a pay-as-you-go model, which allows for better budget management. This model eliminates the need for substantial upfront investments in hardware and software, making it particularly appealing for startups and SMEs. Furthermore, a recent survey indicates that approximately 70% of Canadian businesses report reduced IT costs after migrating to IaaS. This financial advantage, coupled with the ability to allocate resources more effectively, positions IaaS as a compelling option for organizations aiming to optimize their operational expenditures while maintaining high service levels.

Regulatory Compliance and Data Sovereignty

Regulatory compliance is a significant driver influencing the infrastructure as-a-service market in Canada. With stringent data protection laws, such as the Personal Information Protection and Electronic Documents Act (PIPEDA), organizations are compelled to ensure that their data management practices align with legal requirements. This necessity drives the demand for IaaS solutions that offer robust compliance features and data sovereignty. Canadian businesses are increasingly seeking providers that can guarantee data residency within the country, thereby mitigating risks associated with cross-border data transfers. As a result, the infrastructure as-a-service market is likely to see a rise in offerings tailored to meet these regulatory demands, ensuring that organizations can operate within the legal frameworks while leveraging cloud technologies.

Technological Advancements in Cloud Computing

Technological advancements play a crucial role in shaping the infrastructure as-a-service market in Canada. Innovations such as artificial intelligence (AI), machine learning (ML), and automation are enhancing the capabilities of IaaS offerings. These technologies enable organizations to optimize resource allocation, improve performance, and enhance security measures. As Canadian businesses increasingly adopt these advanced technologies, the demand for sophisticated IaaS solutions is expected to rise. Reports suggest that the integration of AI and ML into cloud services could lead to a 20% increase in operational efficiency for companies leveraging IaaS. This trend indicates a strong correlation between technological progress and the growth of the infrastructure as-a-service market.

Increased Focus on Disaster Recovery Solutions

The infrastructure as-a-service market in Canada is witnessing a heightened focus on disaster recovery solutions. Organizations are increasingly recognizing the importance of having robust backup and recovery systems in place to safeguard their data and ensure business continuity. The growing frequency of cyber threats and natural disasters has prompted businesses to invest in IaaS solutions that provide reliable disaster recovery options. Recent studies indicate that nearly 60% of Canadian companies consider disaster recovery capabilities as a critical factor when selecting an IaaS provider. This trend underscores the necessity for organizations to protect their assets, thereby driving growth in the infrastructure as-a-service market as they seek comprehensive solutions that address their recovery needs.