Rising Cybersecurity Concerns

Cybersecurity remains a critical concern for organizations across Canada, significantly impacting the virtual desktop-infrastructure market. With the increasing frequency of cyberattacks, businesses are prioritizing the protection of sensitive data and applications. A recent survey indicated that 75% of Canadian IT leaders consider cybersecurity a top priority in their technology investments. Virtual desktop solutions offer enhanced security features, such as centralized management and data encryption, which are essential for safeguarding corporate information. As organizations seek to mitigate risks associated with data breaches and ensure compliance with regulations, the demand for secure virtual desktop infrastructures is expected to rise. This heightened focus on cybersecurity is likely to drive growth in the virtual desktop-infrastructure market, as companies invest in solutions that provide robust protection against evolving threats.

Increased Focus on Cost Efficiency

Cost efficiency is becoming a pivotal driver for the virtual desktop-infrastructure market in Canada. Organizations are increasingly recognizing the potential for significant cost savings through the adoption of virtual desktop solutions. By centralizing desktop management and reducing the need for physical hardware, companies can lower operational expenses. A study revealed that businesses utilizing virtual desktop infrastructures can reduce IT costs by up to 30%. This financial incentive is particularly appealing to small and medium-sized enterprises (SMEs) that may have limited budgets for IT infrastructure. As organizations strive to optimize their expenditures while maintaining productivity, The market is likely to see increased investment. This focus on cost efficiency is expected to propel the growth of the market as more companies seek to implement solutions that deliver both financial and operational benefits.

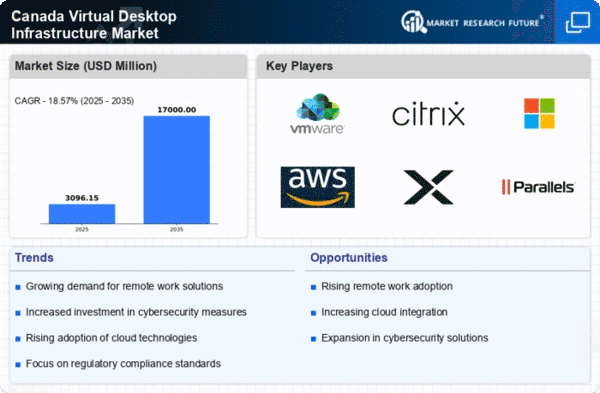

Growing Demand for Remote Work Solutions

The virtual desktop-infrastructure market in Canada is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for secure and efficient remote access to desktop environments has become paramount. According to recent data, approximately 60% of Canadian companies have implemented or are planning to implement remote work policies. This shift necessitates robust virtual desktop solutions that can support diverse workforces while ensuring data security and compliance. The ability to provide employees with seamless access to applications and data from any location is driving investments in virtual desktop technologies. Consequently, this trend is likely to propel the growth of the virtual desktop-infrastructure market, as businesses seek to enhance productivity and maintain operational continuity in a remote work landscape.

Regulatory Compliance and Data Sovereignty

Regulatory compliance and data sovereignty are critical factors influencing the virtual desktop-infrastructure market in Canada. With stringent data protection laws, such as the Personal Information Protection and Electronic Documents Act (PIPEDA), organizations must ensure that their data management practices align with legal requirements. Virtual desktop solutions can facilitate compliance by providing centralized control over data access and storage. Furthermore, the need for data sovereignty, which mandates that data be stored within national borders, is driving the demand for local virtual desktop solutions. As Canadian businesses navigate the complexities of regulatory frameworks, The market is likely to benefit from increased investments in compliant solutions. This focus on regulatory adherence is expected to shape the future landscape of the market, as organizations prioritize secure and compliant virtual desktop environments.

Technological Advancements in Virtualization

Technological advancements in virtualization are significantly influencing the virtual desktop-infrastructure market in Canada. Innovations such as improved graphics processing capabilities, enhanced user experience, and more efficient resource management are making virtual desktop solutions increasingly attractive to businesses. For instance, the introduction of GPU virtualization allows for better performance in graphics-intensive applications, which is particularly beneficial for sectors like design and engineering. Furthermore, the integration of artificial intelligence and machine learning into virtualization technologies is streamlining operations and optimizing resource allocation. As these advancements continue to evolve, they are likely to enhance the appeal of virtual desktop infrastructures, driving adoption across various industries in Canada. This trend suggests a promising future for the virtual desktop-infrastructure market as organizations leverage cutting-edge technologies to improve efficiency and user satisfaction.