Rising Energy Prices

The hydrogen electrolyzer market in Canada is likely to gain traction due to rising energy prices. As traditional energy sources become more expensive, industries are exploring alternative energy solutions to mitigate costs. Hydrogen, produced through electrolysis, presents a viable option for many sectors, including transportation and manufacturing. In 2025, energy prices are expected to rise by approximately 15%, prompting businesses to consider hydrogen as a cost-effective energy source. This economic pressure may lead to increased investments in hydrogen electrolyzers, as companies aim to secure a stable and affordable energy supply. Consequently, the hydrogen electrolyzer market could see accelerated growth as industries pivot towards this alternative energy solution.

Corporate Sustainability Goals

Many Canadian corporations are setting ambitious sustainability targets, which is driving demand for hydrogen electrolyzers. As companies strive to reduce their carbon footprints, they are increasingly looking to hydrogen as a clean energy solution. The hydrogen electrolyzer market is poised to benefit from this trend, as businesses seek to invest in technologies that align with their environmental goals. In 2025, it is estimated that over 60% of large Canadian firms will have adopted hydrogen strategies, further propelling the market. This corporate shift towards sustainability not only enhances the market's growth potential but also encourages innovation in electrolyzer technology, as firms seek to optimize their hydrogen production processes.

Technological Innovation and Research

Ongoing research and development in hydrogen production technologies are significantly influencing the hydrogen electrolyzer market in Canada. Universities and research institutions are collaborating with industry players to enhance the efficiency and reduce the costs of electrolyzers. In 2025, advancements in materials science and engineering are expected to yield electrolyzers with improved performance metrics, potentially reducing energy consumption by up to 20%. This focus on innovation not only enhances the competitiveness of the hydrogen electrolyzer market but also attracts investment from both public and private sectors. As new technologies emerge, they may redefine the landscape of hydrogen production, making it a more attractive option for energy generation.

Investment in Renewable Energy Infrastructure

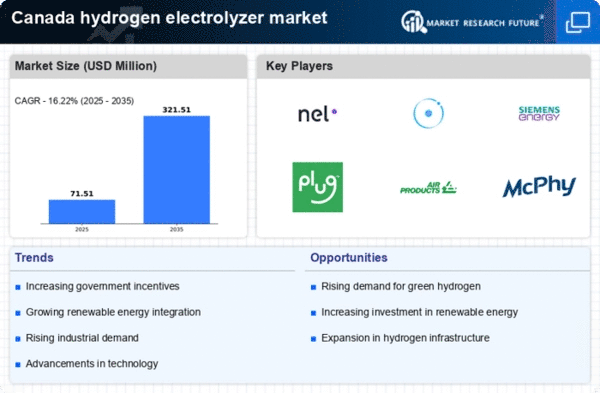

The hydrogen electrolyzer market in Canada is experiencing a surge in investment aimed at enhancing renewable energy infrastructure. Government initiatives and private sector funding are increasingly directed towards projects that integrate hydrogen production with renewable sources such as wind and solar. In 2025, investments in renewable energy projects are projected to exceed $20 billion, with a significant portion allocated to hydrogen technologies. This influx of capital is likely to bolster the hydrogen electrolyzer market, as it facilitates the development of more efficient and scalable electrolyzer systems. Furthermore, the integration of hydrogen production into existing energy frameworks may lead to a more resilient energy grid, thereby enhancing the overall appeal of hydrogen as a clean energy carrier.

Public Awareness and Acceptance of Hydrogen Technologies

The hydrogen electrolyzer market in Canada is benefiting from increasing public awareness and acceptance of hydrogen technologies. Educational campaigns and community engagement initiatives are fostering a better understanding of hydrogen's role in achieving a sustainable energy future. As public perception shifts positively, there is a growing demand for hydrogen solutions across various sectors. In 2025, surveys indicate that over 70% of Canadians support the use of hydrogen as a clean energy source. This societal shift is likely to encourage policymakers to implement supportive regulations and incentives, further propelling the hydrogen electrolyzer market. The alignment of public sentiment with market trends may create a conducive environment for the growth of hydrogen technologies.