Supportive Regulatory Frameworks

Supportive regulatory frameworks are essential for the growth of the hydrogen electrolyzer market. The UK government has established various policies and incentives aimed at promoting hydrogen technologies. Initiatives such as the Hydrogen Strategy and the Ten Point Plan for a Green Industrial Revolution outline clear pathways for hydrogen development. These frameworks provide financial support, regulatory clarity, and market incentives, which are crucial for attracting investment in hydrogen projects. Furthermore, the alignment of these policies with the UK's climate goals enhances the market's attractiveness to stakeholders. As regulations evolve to support cleaner energy solutions, the hydrogen electrolyzer market is likely to see accelerated growth and increased participation from both public and private sectors.

Growing Interest from Industrial Sectors

Growing interest from industrial sectors is a significant driver for the hydrogen electrolyzer market. Industries such as steel, chemicals, and transportation are increasingly exploring hydrogen as a means to decarbonize their operations. The UK steel industry, for example, is actively investigating hydrogen-based processes to reduce carbon emissions, with several pilot projects underway. This trend is indicative of a broader shift towards sustainable practices across various sectors. The potential for hydrogen to serve as a feedstock or energy source presents opportunities for cost savings and compliance with stringent environmental regulations. As more industries recognize the benefits of hydrogen, the market is expected to expand, fostering innovation and collaboration within the hydrogen electrolyzer market.

Investment in Infrastructure Development

Investment in infrastructure development is a critical driver for the hydrogen electrolyzer market. The UK government has committed substantial funding to enhance the hydrogen supply chain, including electrolyzer production facilities and distribution networks. Recent reports indicate that the UK plans to invest over £1 billion in hydrogen projects by 2025, which is expected to bolster the market significantly. This investment not only supports the deployment of electrolyzers but also encourages private sector participation, fostering innovation and competition. As infrastructure improves, the efficiency and accessibility of hydrogen production will likely increase, making it a more viable option for various applications. Consequently, this driver is pivotal in shaping the future landscape of the hydrogen electrolyzer market.

Rising Demand for Clean Energy Solutions

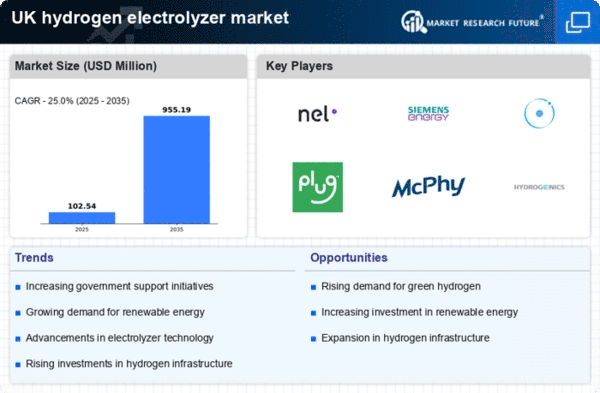

The hydrogen electrolyzer market is experiencing a surge in demand driven by the increasing need for clean energy solutions in the UK. As the government sets ambitious targets for reducing carbon emissions, industries are seeking alternatives to fossil fuels. The UK aims to achieve net-zero emissions by 2050, which necessitates a significant shift towards renewable energy sources. Hydrogen, produced through electrolysis, is seen as a key player in this transition. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next decade, indicating a robust appetite for hydrogen technologies. This demand is further fueled by the rising awareness of climate change and the need for sustainable energy practices across various sectors, including transportation and manufacturing.

Technological Innovations in Electrolysis

Technological innovations in electrolysis are propelling advancements within the hydrogen electrolyzer market. Recent developments in electrolyzer efficiency and cost reduction have made hydrogen production more economically viable. For instance, the introduction of proton exchange membrane (PEM) electrolyzers has enhanced performance, allowing for higher purity hydrogen production at lower operational costs. The market is witnessing a shift towards more efficient systems, with some manufacturers reporting efficiency rates exceeding 80%. These innovations not only improve the competitiveness of hydrogen against traditional energy sources but also align with the UK's goals for sustainable energy. As technology continues to evolve, it is anticipated that the hydrogen electrolyzer market will benefit from increased adoption and integration into existing energy systems.