Focus on Data Security and Compliance

Data security and compliance are paramount concerns for organizations utilizing high performance-computing-as-a-service in Canada. With increasing regulations surrounding data protection, businesses are compelled to ensure that their computing solutions adhere to stringent security standards. The high performance-computing-as-a-service market is responding to this need by offering enhanced security features and compliance certifications. In 2025, it is estimated that 70% of organizations will prioritize security in their computing strategies. This focus on data integrity and compliance is likely to drive the adoption of high performance computing services, as organizations seek reliable solutions that safeguard sensitive information while meeting regulatory requirements.

Rising Need for Scalability and Flexibility

The high performance-computing-as-a-service market in Canada is witnessing a rising need for scalability and flexibility among businesses. As organizations grow and their computational needs evolve, the ability to scale resources quickly becomes essential. High performance computing services offer the flexibility to adjust computing power based on demand, allowing businesses to optimize costs and performance. In 2025, it is projected that 60% of enterprises will prioritize scalable solutions in their IT strategies. This trend indicates a shift towards more adaptable computing environments, which is likely to drive the growth of the high performance-computing-as-a-service market as companies seek to align their resources with their dynamic operational requirements.

Emergence of Collaborative Research Initiatives

Collaborative research initiatives are becoming increasingly prevalent in Canada, significantly impacting the high performance-computing-as-a-service market. Institutions such as universities and research organizations are forming partnerships to share resources and expertise, thereby enhancing their computational capabilities. For example, the Canadian Institute for Advanced Research has launched several programs aimed at fostering collaboration among researchers. These initiatives often require substantial computing power, which drives the demand for high performance computing services. As more collaborative projects emerge, the market is expected to expand, providing opportunities for service providers to cater to the unique needs of these partnerships.

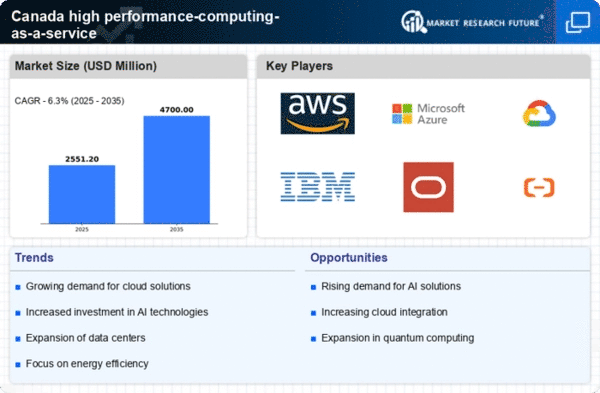

Growing Demand for Advanced Computing Solutions

The high performance-computing-as-a-service market in Canada is experiencing a notable surge in demand for advanced computing solutions. This trend is driven by various sectors, including healthcare, finance, and research, which require substantial computational power for data-intensive applications. For instance, the Canadian government has invested approximately $1.5 billion in supercomputing initiatives, aiming to enhance research capabilities. As organizations increasingly seek to leverage big data and complex simulations, the need for high performance computing services becomes more pronounced. This growing demand is likely to propel the market forward, as businesses recognize the necessity of adopting cutting-edge technologies to maintain competitiveness.

Increased Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the high performance-computing-as-a-service market in Canada. The Canadian government, alongside private enterprises, has allocated significant funds to foster innovation in computing technologies. In 2025, R&D spending in the technology sector is projected to reach $20 billion, reflecting a commitment to advancing computational capabilities. This influx of capital is expected to stimulate the development of new algorithms and software that enhance the efficiency and effectiveness of high performance computing services. Consequently, as R&D efforts intensify, the market is likely to benefit from the introduction of novel solutions that cater to evolving industry needs.