Focus on Functional Beverages

The cold pressed-juice market is aligning with the trend towards functional beverages. These beverages offer added health benefits beyond basic nutrition. Consumers are becoming more aware of the potential health advantages associated with specific ingredients, such as superfoods and adaptogens. This shift is prompting brands to formulate juices that not only taste good but also provide functional benefits, such as improved digestion or enhanced immunity. Recent surveys indicate that nearly 55% of Canadian consumers are actively seeking beverages that contribute to their overall well-being. As the cold pressed-juice market adapts to these consumer preferences, the introduction of functional options is likely to drive sales and foster brand loyalty.

Innovative Packaging Solutions

In the cold pressed-juice market, innovative packaging solutions are emerging as a key driver of growth. Brands are increasingly adopting eco-friendly packaging materials that resonate with environmentally conscious consumers. For instance, the use of biodegradable and recyclable materials is becoming more prevalent, appealing to a demographic that values sustainability. Recent studies indicate that around 60% of Canadian consumers are willing to pay a premium for products that utilize sustainable packaging. This trend not only enhances brand loyalty but also positions companies favorably in a competitive market. As the cold pressed-juice market continues to evolve, the integration of innovative packaging solutions is likely to play a crucial role in attracting and retaining customers who prioritize environmental responsibility.

Expansion of Distribution Channels

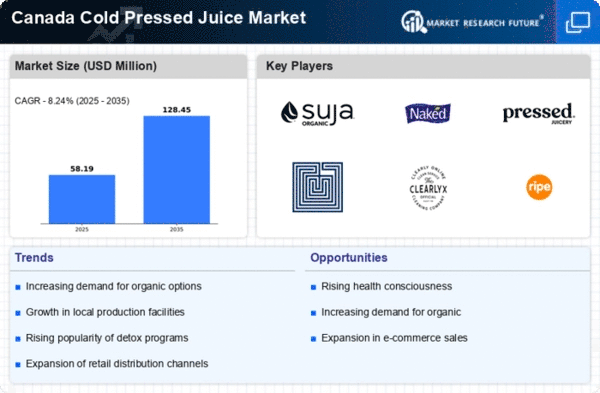

The cold pressed-juice market in Canada is witnessing an expansion of distribution channels. This expansion is significantly impacting accessibility for consumers. Retailers are increasingly incorporating cold pressed juices into their product offerings, with major grocery chains dedicating shelf space to these beverages. Additionally, the rise of e-commerce platforms has facilitated direct-to-consumer sales, allowing brands to reach a broader audience. Recent data suggests that online sales of cold pressed juices have increased by approximately 25% over the past year. This diversification in distribution channels not only enhances market penetration but also caters to the growing demand for convenience among consumers. As more Canadians gain access to cold pressed juices, the market is poised for continued growth.

Growing Interest in Local Sourcing

The cold pressed-juice market in Canada is benefiting from a growing interest in local sourcing of ingredients. Consumers are increasingly inclined to support local farmers and producers, which enhances the appeal of cold pressed juices made from regionally sourced fruits and vegetables. This trend not only promotes sustainability but also fosters a sense of community among consumers. Recent statistics reveal that approximately 65% of Canadians prefer products that are locally sourced, indicating a strong market potential for brands that emphasize their commitment to local agriculture. As the cold pressed-juice market continues to evolve, the focus on local sourcing is likely to play a pivotal role in shaping consumer preferences and driving market growth.

Rising Demand for Natural Ingredients

The cold pressed-juice market in Canada is seeing increased demand for products made from natural ingredients. Consumers are increasingly seeking beverages that are free from artificial additives and preservatives. This trend aligns with a broader movement towards clean eating and transparency in food sourcing. According to recent data, approximately 70% of Canadian consumers express a preference for beverages that contain organic and non-GMO ingredients. This shift is likely to drive growth in the cold pressed-juice market, as brands that emphasize natural sourcing may capture a larger share of the market. Furthermore, the emphasis on health and wellness is expected to continue influencing consumer choices, thereby enhancing the appeal of cold pressed juices that prioritize quality and purity.