Emergence of Subscription Services

The cold pressed-juice market is witnessing the emergence of subscription services that cater to the growing demand for convenience and personalization. These services allow consumers to receive regular deliveries of their favorite juices, tailored to their specific tastes and health goals. This model not only enhances customer loyalty but also provides brands with valuable insights into consumer preferences. Recent market data indicates that subscription-based models are projected to grow by over 20% in the next few years. As more consumers seek hassle-free options for maintaining a healthy lifestyle, the cold pressed-juice market is likely to benefit from this trend, fostering innovation and competition among brands.

Rising Demand for Natural Ingredients

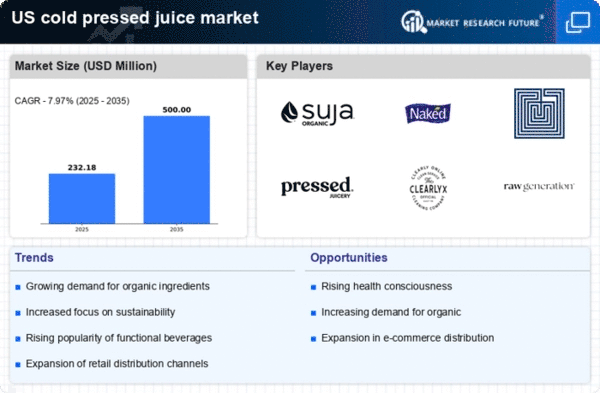

The cold pressed-juice market is experiencing a notable surge in demand for products that emphasize natural ingredients. Consumers are increasingly seeking beverages that are free from artificial additives and preservatives. This trend is driven by a growing awareness of health and wellness, with many individuals opting for juices that are perceived as healthier alternatives. According to recent data, the market for natural beverages, including cold pressed juices, is projected to grow at a CAGR of approximately 8% over the next five years. This shift towards natural ingredients is reshaping the cold pressed-juice market, as brands strive to meet consumer expectations for transparency and quality.

Increased Focus on Functional Beverages

The cold pressed-juice market is witnessing a significant shift towards functional beverages that offer added health benefits. Consumers are increasingly interested in juices that not only quench thirst but also provide nutritional advantages, such as enhanced immunity or digestive support. This trend is reflected in the introduction of cold pressed juices infused with superfoods, vitamins, and minerals. Market analysis indicates that functional beverages are expected to account for over 30% of the total beverage market by 2026. As a result, brands in the cold pressed-juice market are innovating to incorporate these functional elements, appealing to health-conscious consumers seeking more than just refreshment.

Influence of Social Media on Consumer Choices

The cold pressed-juice market is significantly influenced by social media platforms, where health and wellness trends are rapidly disseminated. Influencers and health advocates often promote cold pressed juices as part of a balanced lifestyle, leading to increased consumer interest and trial. This phenomenon is particularly evident among younger demographics, who are more likely to engage with brands that have a strong social media presence. As a result, companies in the cold pressed-juice market are investing in digital marketing strategies to enhance their visibility and connect with potential customers. This trend suggests that social media will continue to play a crucial role in shaping consumer preferences and driving sales.

Growing Popularity of Cold Pressed Juices in Retail

The retail landscape for the cold pressed-juice market is evolving, with an increasing number of grocery stores and health food outlets dedicating shelf space to these products. This trend is fueled by the rising consumer preference for convenient, ready-to-drink options that align with busy lifestyles. Data suggests that sales of cold pressed juices in retail channels have increased by approximately 15% in the past year alone. As more retailers recognize the profitability of this segment, the availability of cold pressed juices is likely to expand, making them more accessible to a broader audience. This shift is expected to further drive growth in the cold pressed-juice market.