Public Awareness and Support

Public awareness regarding climate change and the role of carbon capture technologies is growing in Canada. Increased media coverage and educational initiatives have led to a more informed populace that recognizes the importance of reducing greenhouse gas emissions. This heightened awareness is likely to translate into greater public support for carbon capture projects, which can facilitate smoother project approvals and community acceptance. Furthermore, as citizens advocate for climate action, there may be increased pressure on governments and industries to invest in the carbon capture-storage market. This societal shift could lead to a more favorable environment for the development and deployment of carbon capture technologies across various sectors.

Rising Carbon Pricing Mechanisms

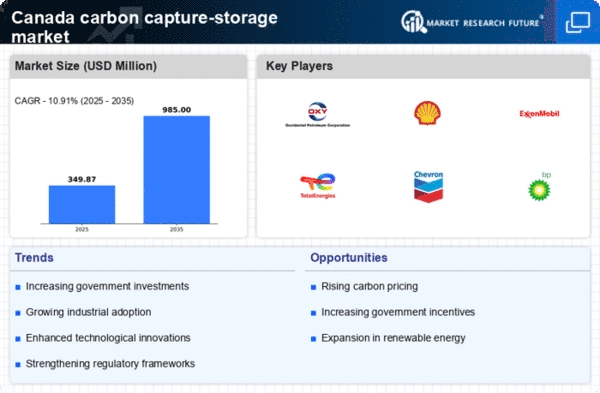

The implementation of carbon pricing mechanisms in Canada is significantly influencing the carbon capture-storage market. As the federal government and various provinces adopt carbon pricing strategies, businesses are incentivized to reduce emissions to avoid financial penalties. The current carbon price is set at $50 per tonne of CO2, with plans to increase to $170 per tonne by 2030. This escalating cost of carbon emissions is likely to drive industries to invest in carbon capture technologies as a cost-effective means of compliance. The carbon capture-storage market stands to gain as companies seek to mitigate their carbon liabilities, fostering a more robust market for carbon capture solutions.

Regulatory Framework Enhancements

The regulatory landscape in Canada is evolving to support the carbon capture-storage market. Recent legislative measures aim to streamline the approval processes for carbon capture projects, thereby reducing the time and costs associated with implementation. The Canadian government has set ambitious targets to reduce greenhouse gas emissions by 40-45% below 2005 levels by 2030. This necessitates the adoption of carbon capture technologies. This regulatory push is likely to create a conducive environment for investments in the carbon capture-storage market, as companies seek to align with national climate goals. Furthermore, the establishment of clear guidelines and standards for carbon storage will enhance investor confidence, potentially leading to a surge in project financing and development in the sector.

Corporate Sustainability Commitments

Many Canadian corporations are increasingly committing to sustainability goals, which is driving demand for carbon capture technologies. As businesses face mounting pressure from stakeholders to reduce their carbon footprints, the carbon capture-storage market is becoming an attractive solution. A survey indicated that over 70% of Canadian companies plan to invest in carbon reduction technologies by 2026. This trend suggests a growing recognition of the importance of carbon capture in achieving corporate sustainability targets. Consequently, the carbon capture-storage market is likely to benefit from increased investments as companies seek to implement effective carbon management strategies, thereby contributing to national emission reduction efforts.

Investment in Infrastructure Development

Investment in infrastructure is a critical driver for the carbon capture-storage market in Canada. The government has allocated substantial funding to develop the necessary infrastructure for carbon capture technologies, including pipelines and storage facilities. For instance, the Canadian government announced a $1.5 billion investment in carbon capture projects, which is expected to catalyze further private sector investments. This influx of capital is likely to facilitate the construction of new facilities and the retrofitting of existing ones, thereby expanding the operational capacity of the carbon capture-storage market. Additionally, enhanced infrastructure will improve the efficiency of carbon transport and storage, making it more economically viable for industries to adopt these technologies.