Corporate Sustainability Goals

Many corporations in the US are establishing sustainability goals that include carbon neutrality targets. This trend is significantly influencing the carbon capture-storage market as companies seek to reduce their carbon footprints. Major corporations, particularly in the energy and manufacturing sectors, are committing to ambitious targets, with some aiming for net-zero emissions by 2050. This commitment often involves investing in carbon capture technologies to offset emissions from their operations. For example, companies like Microsoft and Amazon have pledged to become carbon negative by 2030, which necessitates the adoption of effective carbon capture solutions. As more businesses recognize the importance of sustainability in their operations, the demand for carbon capture technologies is expected to rise, thereby driving growth in the carbon capture-storage market.

Investment in Renewable Energy

The transition towards renewable energy sources is a significant driver for the carbon capture-storage market. As the US aims to reduce its reliance on fossil fuels, investments in renewable energy technologies are surging. The Biden administration has set ambitious targets to achieve a 50-52% reduction in greenhouse gas emissions by 2030, which necessitates the integration of carbon capture solutions in renewable energy projects. For instance, the deployment of carbon capture technologies in bioenergy production can enhance the sustainability of these initiatives. The market for carbon capture in conjunction with renewable energy is projected to grow, with estimates suggesting a potential increase in investment to over $100 billion by 2030. This synergy between renewable energy and carbon capture is likely to create new opportunities within the carbon capture-storage market.

Growing Environmental Awareness

The increasing awareness of climate change and its impacts is driving the carbon capture-storage market. As individuals and organizations recognize the need for sustainable practices, there is a growing demand for technologies that can mitigate carbon emissions. This heightened environmental consciousness is reflected in various sectors, including energy, manufacturing, and transportation. In the US, public sentiment is shifting towards supporting initiatives that promote carbon reduction. According to recent surveys, approximately 70% of Americans believe that climate change is a serious issue, which is likely to influence policy decisions and corporate strategies. Consequently, companies are investing in carbon capture technologies to align with consumer expectations and regulatory requirements, thereby propelling the carbon capture-storage market forward.

Federal and State Policy Initiatives

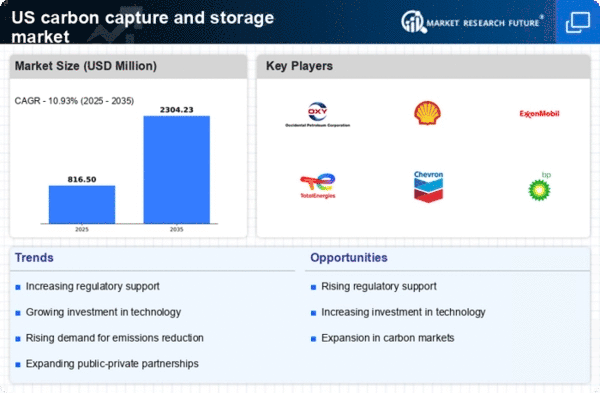

The carbon capture-storage market is being significantly influenced by federal and state policy initiatives aimed at reducing carbon emissions. Legislative measures, such as the Infrastructure Investment and Jobs Act, have allocated substantial funding for carbon capture projects. Additionally, various states are implementing their own policies to promote carbon capture technologies, including tax credits and grants. For instance, the 45Q tax credit provides financial incentives for carbon capture projects, allowing companies to receive up to $50 per ton of captured carbon dioxide. These policy frameworks are designed to stimulate investment in carbon capture technologies, thereby enhancing the market's growth potential. As regulatory support continues to evolve, it is likely that the carbon capture-storage market will experience increased activity and innovation.

Technological Integration and Innovation

The integration of advanced technologies is a crucial driver for the carbon capture-storage market. Innovations in carbon capture methods, such as direct air capture and enhanced oil recovery, are enhancing the efficiency and effectiveness of carbon capture solutions. Research and development efforts are focusing on improving the scalability and cost-effectiveness of these technologies. For instance, recent advancements in membrane technology and solvent-based capture processes are showing promise in reducing operational costs. The carbon capture-storage market is likely to benefit from these technological innovations, as they can lead to more widespread adoption of carbon capture solutions across various industries. Furthermore, collaboration between research institutions and private companies is fostering an environment of innovation, which may further accelerate the growth of the carbon capture-storage market.