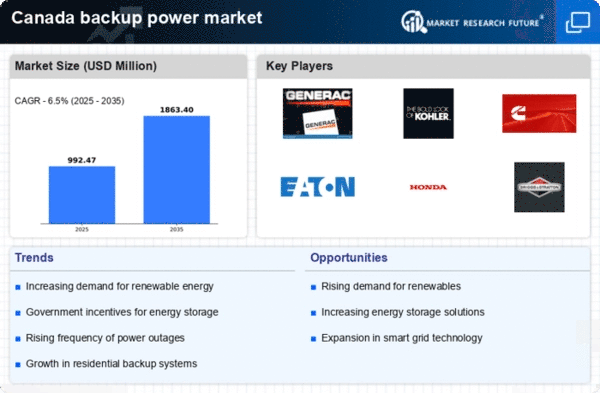

Rising Frequency of Power Outages

The increasing frequency of power outages in Canada has emerged as a critical driver for the backup power market. According to recent data, the number of outages has risen by approximately 30% over the past decade, primarily due to aging infrastructure and extreme weather events. This trend compels both residential and commercial sectors to invest in backup power solutions to ensure continuity of operations. The backup power market is witnessing heightened demand for generators and battery storage systems as businesses and homeowners seek reliable alternatives to mitigate the impact of outages. As a result, the market is expected to grow significantly, with projections indicating a potential increase in revenue by over 20% in the next five years.

Growing Awareness of Energy Security

In Canada, there is a growing awareness regarding energy security, which is significantly influencing the backup power market. As consumers become more informed about the vulnerabilities of the electrical grid, the demand for backup power solutions is likely to increase. This awareness is driven by various factors, including media coverage of outages and discussions around energy independence. The backup power market is responding to this trend by offering a wider range of products, including portable generators and home battery systems. Market analysts suggest that this shift could lead to a 15% increase in market penetration among residential users by 2026, as more households prioritize energy resilience.

Technological Innovations in Energy Storage

Technological innovations in energy storage are reshaping the landscape of the backup power market in Canada. Advances in battery technology, such as lithium-ion and solid-state batteries, are enhancing the efficiency and affordability of backup power systems. These innovations are making it feasible for both residential and commercial users to adopt backup solutions that were previously cost-prohibitive. The backup power market is witnessing a surge in demand for these advanced systems, with market forecasts suggesting a potential growth rate of 18% over the next five years. As technology continues to evolve, it is likely that the market will see even more sophisticated solutions that cater to diverse energy needs.

Regulatory Changes Favoring Backup Power Solutions

Recent regulatory changes in Canada are favoring the adoption of backup power solutions, thereby impacting the backup power market. Government initiatives aimed at promoting energy efficiency and sustainability are encouraging businesses and homeowners to invest in backup systems. For instance, incentives for renewable energy integration and energy storage solutions are becoming more prevalent. The backup power market is likely to benefit from these regulations, as they create a more favorable environment for investment. Analysts predict that compliance with new regulations could lead to a 10% growth in the market as stakeholders seek to align with governmental energy policies.

Increased Urbanization and Infrastructure Development

The rapid urbanization and infrastructure development in Canada are contributing to the expansion of the backup power market. As cities grow, the demand for reliable power sources becomes more pronounced, particularly in urban centers where power outages can disrupt daily life and business operations. The backup power market is adapting to this demand by innovating solutions tailored for urban environments, such as compact generators and integrated energy storage systems. Recent studies indicate that urban areas could see a 25% increase in the adoption of backup power solutions over the next few years, driven by both residential and commercial sectors seeking to enhance their energy reliability.