By region, the study provides market insights into North America, Europe, Asia-Pacific, and Rest of the World. Growth in the North American region is being propelled by initiatives focused on food fortification, aimed at promoting a healthy diet and addressing health concerns, particularly malnutrition and micronutrient deficiencies. The market for Calcium-Fortified Food is expected to expand as consumers in this region become increasingly aware of deficiencies in nutrients like iodine, vitamins A & D, and myopia. The country's market is experiencing growth due to heightened consumer interest and awareness regarding the immune-boosting properties of a proper diet and eating habits.

For example, research, as outlined in a report by the US Bone and Joint Health Initiative (USBJI), reveals that one in two Americans suffers from musculoskeletal conditions, resulting in an estimated annual cost of USD 213 billion, encompassing both treatment expenses and lost wages. This indicates a significant market potential for health-focused dietary products.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

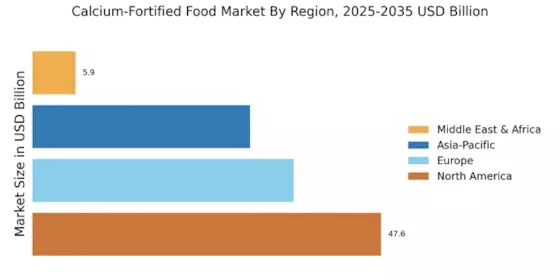

Figure 2: CALCIUM-FORTIFIED FOOD MARKET SHARE BY REGION 2022 (USD Billion)

Europe's Calcium-Fortified Food Market accounts for the second-largest market share as The European Calcium-Fortified Food Market is poised for significant growth, driven by well-established fortified food industries and heightened health consciousness among consumers. According to Glanbia plc, The United Kingdom leads the market for functional/fortified foods and beverages with a substantial 23% market share, followed by Germany (16%), France (12%), Spain (10%), and Italy (9%). In the European landscape, the UK dominates the market for functional/fortified packaged foods, while Germany takes the lead in the beverage sector.

The COVID-19 pandemic has had a discernible impact on the food and beverage market in Europe, with more consumers actively seeking products to bolster their health. According to FMCG Gurus, 41% of European consumers have conducted research on healthier eating and drinking habits as a direct response to COVID-19. An additional 41% have shown an increased interest in functional products that contain health-enhancing ingredients. These trends indicate a growing market for health-conscious products in the European region.

Further, the German Calcium-Fortified Food Market held the largest market share, and the UK Calcium-Fortified Food Market was the fastest-growing market in the European region

The Asia-Pacific Calcium-Fortified Food Market is expected to grow at the fastest CAGR from 2023 to 2032. Osteoporosis has emerged as a noteworthy concern in the Asia-Pacific region, especially among the female population. According to the Asian Federation of Osteoporosis Societies (AFOS) in 2018, it was estimated that China witnessed around 485,000 hip fractures, while India had approximately 332,000 cases. These fractures had considerable implications for healthcare costs.

In 2018, across countries such as China, Chinese Taipei, Hong Kong SAR, India, Japan, Malaysia, Singapore, South Korea, and Thailand, it was estimated that over 1.1 million hip fractures occurred, resulting in a direct cost of USD 7.5 billion. Looking ahead to 2050, the number of hip fractures is projected to increase by 2.3-fold, reaching over 2.5 million cases annually. This anticipated surge would result in substantial projected costs, approaching almost USD 13 billion. In the context of business, this underscores the significant market potential for calcium-fortified foods.

These products offer a convenient source of the essential mineral calcium, which plays a vital role in addressing the osteoporosis challenge, particularly among aging populations in the Asia-Pacific region. As osteoporosis continues to be a health concern, calcium-fortified foods can meet the nutritional needs of consumers and potentially contribute to better bone health, offering a promising market opportunity for such products. Moreover, China’s Calcium-Fortified Food Market held the largest market share, and the Indian Calcium-Fortified Food Market was the fastest-growing market in the Asia-Pacific region.