Aging Population

The aging population is a primary driver of the bone and joint health ingredient Market. As individuals age, they often experience a decline in bone density and joint health, leading to increased demand for supplements and functional foods that support these areas. According to recent data, the proportion of individuals aged 65 and older is projected to rise significantly, which correlates with a heightened focus on preventive health measures. This demographic shift is likely to propel the market for bone and joint health ingredients, as older adults seek to maintain mobility and quality of life. Consequently, manufacturers are responding by developing targeted products that cater to the specific needs of this age group, thereby expanding their market reach and enhancing consumer engagement.

Increased Sports Participation

Increased sports participation among various age groups is significantly impacting the Bone and Joint Health Ingredient Market. As more individuals engage in physical activities, the risk of joint injuries and conditions such as arthritis rises. This trend has led to a greater emphasis on preventive care and recovery solutions, driving demand for ingredients that promote joint health and reduce inflammation. Market data suggests that the sports nutrition segment is expanding rapidly, with consumers actively seeking products that enhance performance and support recovery. Consequently, manufacturers are innovating to create specialized formulations that cater to athletes and active individuals, thereby tapping into a lucrative segment of the bone and joint health market.

Rising Incidence of Osteoporosis

The rising incidence of osteoporosis is a critical factor influencing the Bone and Joint Health Ingredient Market. Osteoporosis, characterized by weakened bones and increased fracture risk, affects millions worldwide, particularly postmenopausal women. Recent statistics indicate that approximately 200 million women globally are affected by this condition, which underscores the urgent need for effective preventive and therapeutic solutions. This growing prevalence drives demand for ingredients such as calcium, vitamin D, and collagen, which are known to support bone health. As awareness of osteoporosis increases, consumers are more inclined to seek out products that can help mitigate its effects, thus creating a robust market for bone and joint health ingredients.

Growing Interest in Preventive Health

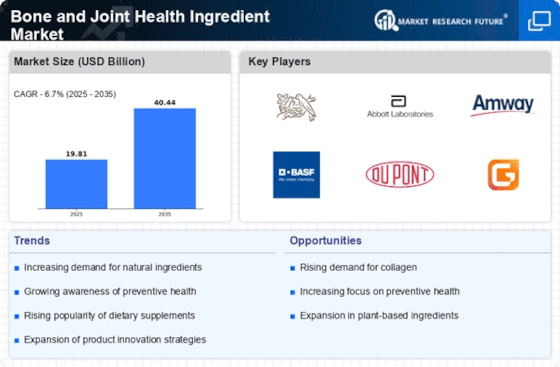

The growing interest in preventive health is reshaping the Bone and Joint Health Ingredient Market. Consumers are increasingly prioritizing wellness and proactive health measures, leading to a surge in demand for dietary supplements and functional foods that support bone and joint health. This trend is reflected in market data, which indicates a steady increase in sales of products containing glucosamine, chondroitin, and other beneficial ingredients. As individuals become more health-conscious, they are likely to invest in products that promise long-term benefits, thereby driving market growth. Manufacturers are responding by emphasizing the health benefits of their offerings, which further fuels consumer interest and engagement in the bone and joint health sector.

Technological Advancements in Ingredient Sourcing

Technological advancements in ingredient sourcing are playing a pivotal role in the Bone and Joint Health Ingredient Market. Innovations in extraction and processing techniques have enhanced the bioavailability and efficacy of key ingredients, making them more appealing to consumers. For instance, advancements in collagen sourcing have led to the development of high-quality, bioactive peptides that are more easily absorbed by the body. This has resulted in a proliferation of products that effectively support bone and joint health. Furthermore, as manufacturers adopt these technologies, they can offer cleaner labels and more sustainable sourcing options, which resonate with the growing consumer demand for transparency and quality in health products. This trend is likely to continue shaping the market landscape.