Expansion of Self-Service Analytics

The Business Intelligence Software Market is currently benefiting from the expansion of self-service analytics tools. These tools empower non-technical users to access and analyze data without relying heavily on IT departments. This democratization of data analytics is fostering a culture of data literacy within organizations, enabling employees at all levels to derive insights from data. As a result, the market is projected to witness a substantial increase in the adoption of self-service solutions, which are anticipated to account for a significant portion of overall business intelligence software revenues. This trend not only enhances productivity but also accelerates the decision-making process across various sectors.

Integration of Advanced Analytics Techniques

The Business Intelligence Software Market is increasingly integrating advanced analytics techniques, such as predictive and prescriptive analytics, into their offerings. This integration allows organizations to not only analyze historical data but also forecast future trends and make proactive decisions. The demand for such capabilities is on the rise, as businesses seek to gain a competitive edge through data-driven insights. Market analysts suggest that the incorporation of these advanced techniques could lead to a substantial increase in market size, as organizations recognize the potential of leveraging analytics for strategic planning and operational improvements. This trend is likely to shape the future landscape of business intelligence software.

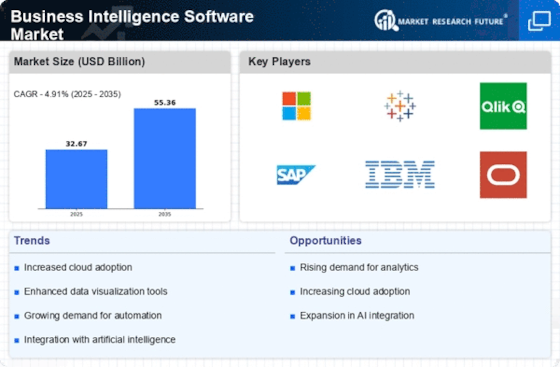

Growing Demand for Data-Driven Decision Making

The Business Intelligence Software Market is experiencing a notable surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies are leveraging data analytics to enhance operational efficiency, improve customer experiences, and drive strategic initiatives. According to recent estimates, the market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is largely attributed to the need for real-time insights and the ability to make informed decisions based on comprehensive data analysis. As businesses strive to remain competitive, the adoption of business intelligence solutions becomes essential, thereby propelling the market forward.

Increased Focus on Data Security and Compliance

In the current landscape, the Business Intelligence Software Market is witnessing an increased emphasis on data security and compliance. Organizations are becoming more aware of the risks associated with data breaches and the importance of adhering to regulatory standards. This heightened focus is driving the demand for business intelligence solutions that incorporate robust security features and compliance capabilities. As a result, software providers are enhancing their offerings to include advanced security measures, which is likely to attract more clients. The market is expected to see a significant uptick in solutions that not only provide analytics but also ensure data integrity and protection, thus fostering trust among users.

Rising Adoption of Mobile Business Intelligence Solutions

The Business Intelligence Software Market is witnessing a rising adoption of mobile business intelligence solutions. As the workforce becomes increasingly mobile, the need for accessing data and analytics on-the-go is becoming paramount. Organizations are investing in mobile-friendly business intelligence tools that allow employees to access critical insights from their smartphones and tablets. This trend is expected to drive market growth, as mobile solutions enhance flexibility and responsiveness in decision-making processes. Furthermore, the convenience of mobile access is likely to encourage more organizations to adopt business intelligence software, thereby expanding the overall market reach and user base.