US Business Intelligence Market Summary

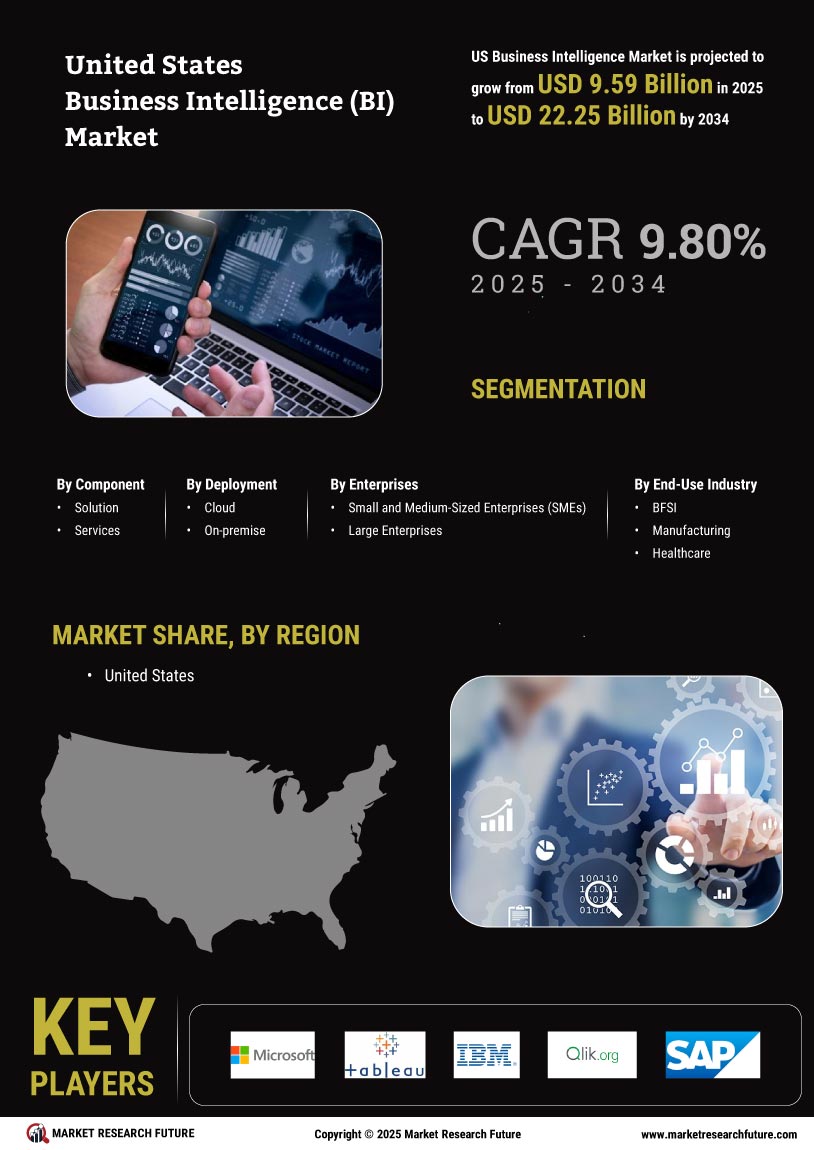

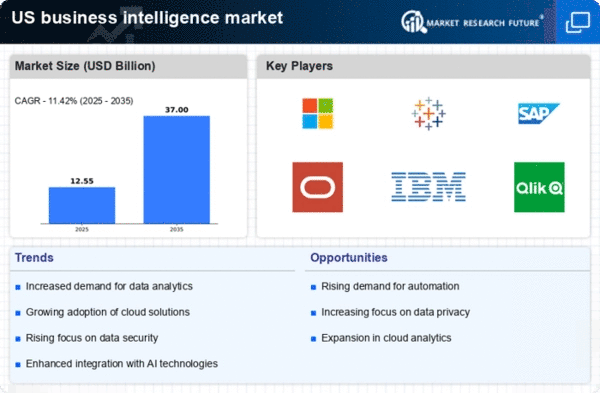

As per Market Research Future analysis, the US business intelligence market size was estimated at 11.26 USD Billion in 2024. The US business intelligence market is projected to grow from 12.55 USD Billion in 2025 to 37.0 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 11.4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US The US business intelligence market is experiencing robust growth. This growth is driven by technological advancements and evolving user needs.

- The largest segment in the US business intelligence market is the cloud-based solutions segment, which continues to see increased adoption.

- Data visualization tools are gaining traction as organizations prioritize intuitive and effective ways to present data insights.

- Predictive analytics is emerging as a key focus area, enabling businesses to forecast trends and make informed decisions.

- The rising demand for real-time data analysis and the integration of artificial intelligence and machine learning are major drivers of market growth.

Market Size & Forecast

| 2024 Market Size | 11.26 (USD Billion) |

| 2035 Market Size | 37.0 (USD Billion) |

| CAGR (2025 - 2035) | 11.42% |

Major Players

Microsoft (US), Tableau (US), SAP (DE), Oracle (US), IBM (US), Qlik (US), SAS (US), MicroStrategy (US), Domo (US)