Rise of Digital Payment Solutions

The Business Analytics In Fintech Market is experiencing a notable rise in digital payment solutions, which is driving the demand for analytics tools. As consumers increasingly prefer digital transactions over traditional methods, fintech companies are compelled to analyze transaction data to optimize their payment offerings. The digital payments market is projected to grow exponentially, with estimates suggesting a valuation of over a trillion dollars in the coming years. This growth necessitates the implementation of advanced analytics to monitor transaction patterns, detect anomalies, and enhance security measures. Consequently, fintech firms are investing in business analytics solutions that can provide actionable insights into payment trends and customer behavior. This trend not only supports the growth of digital payment solutions but also plays a crucial role in shaping the future of the Business Analytics In Fintech Market.

Emergence of Advanced Analytical Tools

The Business Analytics In Fintech Market is witnessing the emergence of advanced analytical tools that facilitate deeper insights into consumer behavior and market trends. Technologies such as predictive analytics, big data analytics, and machine learning algorithms are becoming increasingly prevalent. These tools enable fintech companies to analyze vast amounts of data, uncover patterns, and make informed decisions. For instance, the adoption of predictive analytics is expected to enhance customer segmentation and targeting, leading to improved marketing strategies. Furthermore, the market for these advanced tools is anticipated to reach a valuation of several billion dollars by 2026, indicating a robust growth trajectory. As fintech firms continue to harness these technologies, the demand for sophisticated analytics solutions will likely intensify, further propelling the Business Analytics In Fintech Market.

Growing Importance of Customer Experience

The Business Analytics In Fintech Market is increasingly prioritizing customer experience as a key driver of growth. Fintech companies are leveraging analytics to gain insights into customer preferences and behaviors, enabling them to tailor their offerings accordingly. Enhanced customer experience is linked to higher retention rates and increased customer loyalty, which are vital for long-term success. Recent studies indicate that companies that prioritize customer experience are likely to outperform their competitors by a significant margin. As a result, the demand for business analytics solutions that focus on customer insights is expected to rise. This trend highlights the necessity for fintech firms to invest in analytics capabilities that can provide a comprehensive understanding of customer journeys, ultimately shaping the trajectory of the Business Analytics In Fintech Market.

Regulatory Pressures and Compliance Needs

The Business Analytics In Fintech Market is significantly influenced by regulatory pressures and compliance needs. As financial regulations become more stringent, fintech companies are compelled to adopt robust analytics solutions to ensure compliance with various legal requirements. The need for transparency and accountability in financial transactions has led to an increased focus on data analytics for risk assessment and fraud detection. Recent data suggests that the compliance analytics market is expected to grow substantially, driven by the necessity for real-time monitoring and reporting. Consequently, fintech firms are investing in business analytics tools that not only streamline compliance processes but also enhance overall operational efficiency. This trend underscores the critical role of analytics in navigating the complex regulatory landscape, thereby shaping the future of the Business Analytics In Fintech Market.

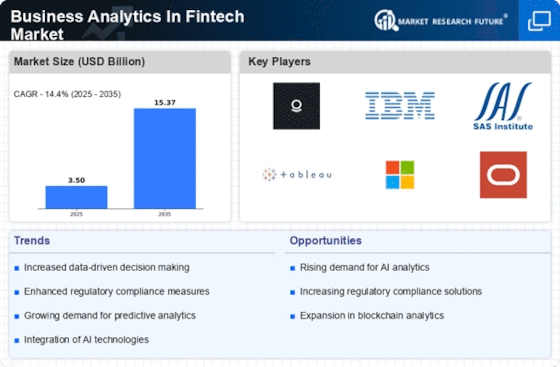

Increased Demand for Data-Driven Decision Making

The Business Analytics In Fintech Market is experiencing a surge in demand for data-driven decision making. Financial institutions are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and customer satisfaction. According to recent estimates, the market for business analytics in the fintech sector is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is driven by the need for real-time insights that can inform strategic decisions, optimize resource allocation, and improve risk management. As fintech companies continue to innovate, the integration of advanced analytics tools becomes essential for maintaining a competitive edge. Consequently, the emphasis on data-driven strategies is likely to shape the future landscape of the Business Analytics In Fintech Market.