Busbar Trunking System Market Summary

As per Market Research Future analysis, the Busbar Trunking System Market Size was estimated at 6.6 USD Billion in 2024. The Busbar Trunking System industry is projected to grow from 6.978 USD Billion in 2025 to 12.17 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.7% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Busbar Trunking System Market is poised for substantial growth driven by technological advancements and sustainability initiatives.

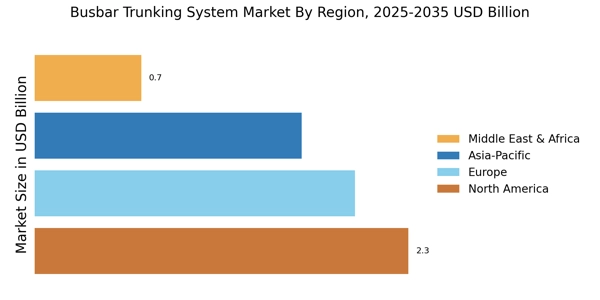

- North America remains the largest market for busbar trunking systems, reflecting robust infrastructure investments.

- Asia-Pacific is emerging as the fastest-growing region, fueled by rapid industrialization and urbanization.

- Copper continues to dominate the market as the largest segment, while aluminum is gaining traction as the fastest-growing alternative.

- Rising demand for energy efficiency and government initiatives for infrastructure development are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 6.6 (USD Billion) |

| 2035 Market Size | 12.17 (USD Billion) |

| CAGR (2025 - 2035) | 5.72% |

Major Players

Schneider Electric (FR), Siemens (DE), ABB (CH), Eaton (US), General Electric (US), Legrand (FR), C&S Electric (IN), Mitsubishi Electric (JP), Rittal (DE)